Time Series Analysis

Introduction

The objective of time series analysis is to uncover a pattern in a time series and then extrapolate the pattern into the future. Being able to forecast the future is the essence of time series analysis.

The forecast is based solely on past values of the variable and/or on past forecast errors.

Why forecast?

Forecasting applies to many business situations: forecasting demand with a view to make capacity build-out decision, staff scheduling in a call center, understanding the demand for credit, determining the inventory to order in anticipation of demand, etc. Forecast timescales may differ based on needs: some situations require forecasting years ahead, while others may require forecasts for the next day, or the even the next minute.

What is a time series?

A time series is a sequence of observations on a variable measured at successive points in time or over successive periods of time.

The measurements may be taken every hour, day, week, month, year, or any other regular interval. The pattern of the data is important in understanding the series’ past behavior.

If the behavior of the times series data of the past is expected to continue in the future, it can be used as a guide in selecting an appropriate forecasting method.

Let us look at an example.

As usual, some library imports first

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

plt.rcParams['figure.figsize'] = (20, 9)

Loading the data

Let us load some data: https://data.seattle.gov/Transportation/Fremont-Bridge-Bicycle-Counter/65db-xm6k.

This is a picture of the bridge. The second picture shows the bicycle counter.

(Photo retrieved from a Google search, credit: Jason H, 2020))

(Photo retrieved from a Google search, credit: Jason H, 2020))

(Photo retrieved from: http://www.sheridestoday.com/blog/2015/12/21/fremont-bridge-bike-counter)

# Load the data

# You can get more information on this dataset at

# https://data.seattle.gov/Transportation/Fremont-Bridge-Bicycle-Counter/65db-xm6k

df = pd.read_csv('https://data.seattle.gov/api/views/65db-xm6k/rows.csv')

# Review the column names

df.columns

Index(['Date', 'Fremont Bridge Sidewalks, south of N 34th St',

'Fremont Bridge Sidewalks, south of N 34th St Cyclist East Sidewalk',

'Fremont Bridge Sidewalks, south of N 34th St Cyclist West Sidewalk'],

dtype='object')

df

| Date | Fremont Bridge Sidewalks, south of N 34th St | Fremont Bridge Sidewalks, south of N 34th St Cyclist East Sidewalk | Fremont Bridge Sidewalks, south of N 34th St Cyclist West Sidewalk | |

|---|---|---|---|---|

| 0 | 08/01/2022 12:00:00 AM | 23.0 | 7.0 | 16.0 |

| 1 | 08/01/2022 01:00:00 AM | 12.0 | 5.0 | 7.0 |

| 2 | 08/01/2022 02:00:00 AM | 3.0 | 0.0 | 3.0 |

| 3 | 08/01/2022 03:00:00 AM | 5.0 | 2.0 | 3.0 |

| 4 | 08/01/2022 04:00:00 AM | 10.0 | 2.0 | 8.0 |

| ... | ... | ... | ... | ... |

| 95635 | 08/31/2023 07:00:00 PM | 224.0 | 72.0 | 152.0 |

| 95636 | 08/31/2023 08:00:00 PM | 142.0 | 59.0 | 83.0 |

| 95637 | 08/31/2023 09:00:00 PM | 67.0 | 35.0 | 32.0 |

| 95638 | 08/31/2023 10:00:00 PM | 43.0 | 18.0 | 25.0 |

| 95639 | 08/31/2023 11:00:00 PM | 12.0 | 8.0 | 4.0 |

95640 rows × 4 columns

# df.to_excel('Bridge_crossing_data_07Nov2023.xlsx')

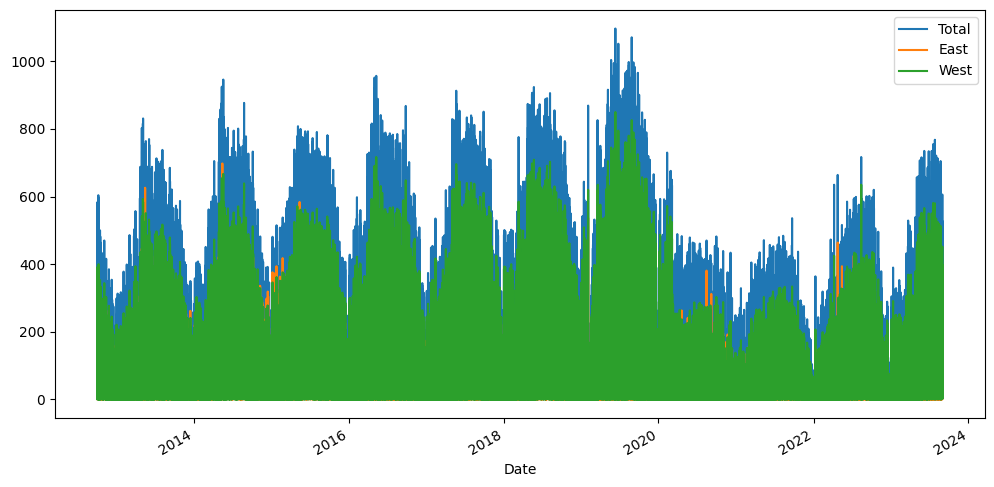

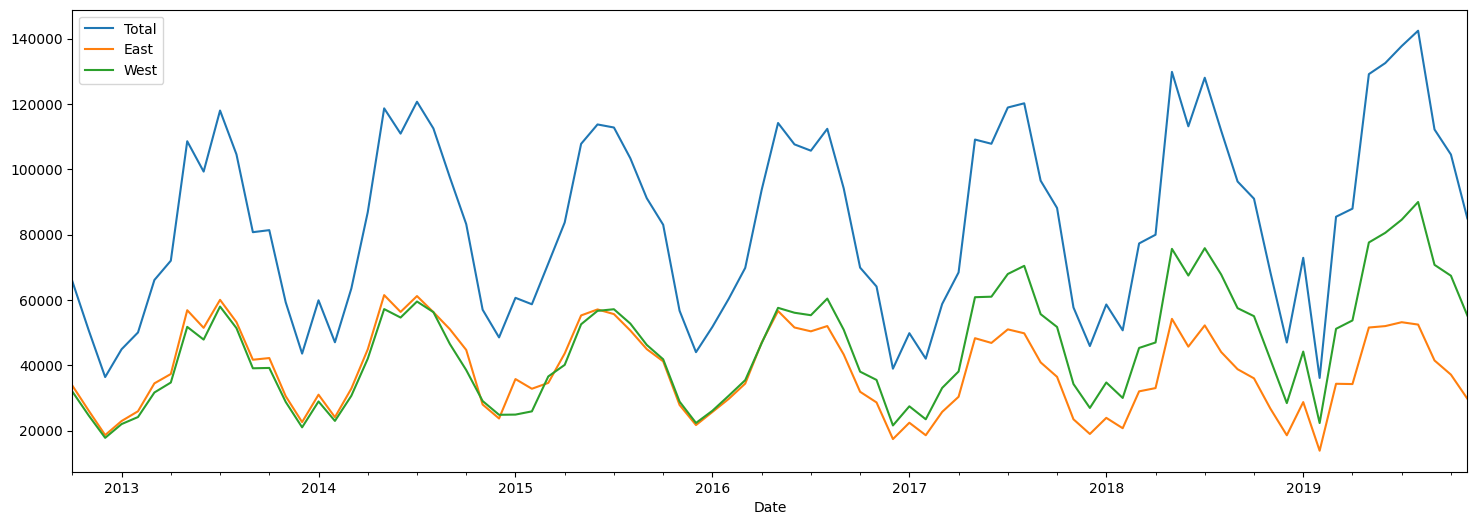

We have hourly data on bicycle crossings with three columns, Total = East + West sidewalks. Our data is from 2012 all the way to July 2021, totaling 143k+ rows.

For doing time series analysis with Pandas, the data frame's index should be equal to the datetime for the row.

For convenience, we also rename the column names to be ['Total', 'East', 'West'].

# Set the index of the time series

df.index = pd.DatetimeIndex(df.Date)

# Now drop the Date column as it is a part of the index

df.drop(columns='Date', inplace=True)

df.head()

| Fremont Bridge Sidewalks, south of N 34th St | Fremont Bridge Sidewalks, south of N 34th St Cyclist East Sidewalk | Fremont Bridge Sidewalks, south of N 34th St Cyclist West Sidewalk | |

|---|---|---|---|

| Date | |||

| 2022-08-01 00:00:00 | 23.0 | 7.0 | 16.0 |

| 2022-08-01 01:00:00 | 12.0 | 5.0 | 7.0 |

| 2022-08-01 02:00:00 | 3.0 | 0.0 | 3.0 |

| 2022-08-01 03:00:00 | 5.0 | 2.0 | 3.0 |

| 2022-08-01 04:00:00 | 10.0 | 2.0 | 8.0 |

# Rename the columns to make them simpler to use

df.columns = ['Total', 'East', 'West']

Data Exploration

df.shape

(95640, 3)

# Check the maximum and the minimum dates in our data

print(df.index.max())

print(df.index.min())

2023-08-31 23:00:00

2012-10-03 00:00:00

# Let us drop NaN values

df.dropna(inplace=True)

df.shape

(95614, 3)

# Let us look at some sample rows

df.head(10)

| Total | East | West | |

|---|---|---|---|

| Date | |||

| 2022-08-01 00:00:00 | 23.0 | 7.0 | 16.0 |

| 2022-08-01 01:00:00 | 12.0 | 5.0 | 7.0 |

| 2022-08-01 02:00:00 | 3.0 | 0.0 | 3.0 |

| 2022-08-01 03:00:00 | 5.0 | 2.0 | 3.0 |

| 2022-08-01 04:00:00 | 10.0 | 2.0 | 8.0 |

| 2022-08-01 05:00:00 | 27.0 | 5.0 | 22.0 |

| 2022-08-01 06:00:00 | 100.0 | 43.0 | 57.0 |

| 2022-08-01 07:00:00 | 219.0 | 90.0 | 129.0 |

| 2022-08-01 08:00:00 | 335.0 | 143.0 | 192.0 |

| 2022-08-01 09:00:00 | 212.0 | 85.0 | 127.0 |

# We plot the data

# Pandas knows that this is a time-series, and creates the right plot

df.plot(kind = 'line',figsize=(12,6));

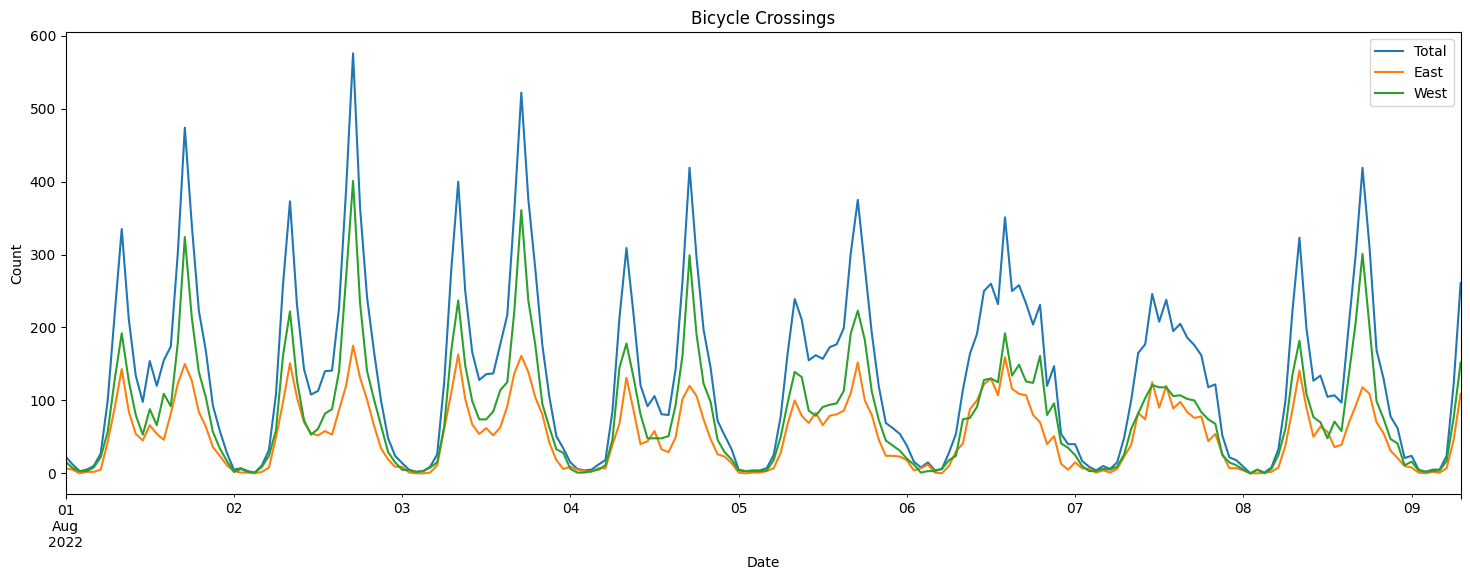

# Let us look at just the first 200 data points

title='Bicycle Crossings'

ylabel='Count'

xlabel='Date'

ax = df.iloc[:200,:].plot(figsize=(18,6),title=title)

ax.autoscale(axis='x',tight=True)

ax.set(xlabel=xlabel, ylabel=ylabel);

Resampling

resample() is a time-based groupby pandas has a simple, powerful, and efficient functionality for performing resampling operations during frequency conversion (e.g., converting secondly data into 5-minutely data). This is extremely common in, but not limited to, financial applications.

The resample function is very flexible and allows you to specify many different parameters to control the frequency conversion and resampling operation.

Many functions are available as a method of the returned object, including sum, mean, std, sem, max, min, median, first, last, ohlc.

| Alias | Description |

|---|---|

| B | business day frequency |

| D | calendar day frequency |

| W | weekly frequency |

| M | month end frequency |

| SM | semi-month end frequency (15th and end of month) |

| BM | business month end frequency |

| MS | month start frequency |

| Q | quarter end frequency |

| A, Y | year end frequency |

| H | hourly frequency |

| T, min | minutely frequency |

| S | secondly frequency |

| N | nanoseconds |

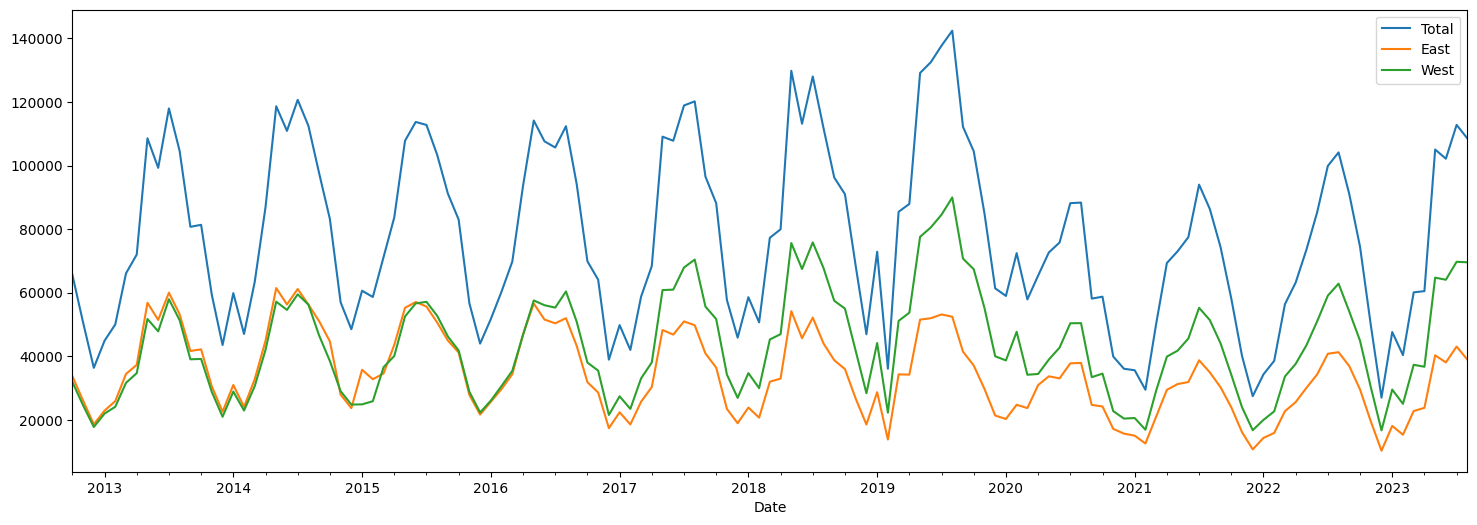

# Let us resample the data to be monthly

df.resample(rule='M').sum().plot(figsize = (18,6));

# Let us examine monthly data

# We create a new monthly dataframe

df_monthly = df.resample(rule='M').sum()

# Just to keep our analysis clean and be able to understand concepts,

# we will limit ourselves to pre-Covid data

df_precovid = df_monthly[df_monthly.index < pd.to_datetime('2019-12-31')]

df_precovid.plot(figsize = (18,6));

# We suppress some warnings pandas produces, more for

# visual cleanliness than any other reason

pd.options.mode.chained_assignment = None

df_monthly

| Total | East | West | |

|---|---|---|---|

| Date | |||

| 2012-10-31 | 65695.0 | 33764.0 | 31931.0 |

| 2012-11-30 | 50647.0 | 26062.0 | 24585.0 |

| 2012-12-31 | 36369.0 | 18608.0 | 17761.0 |

| 2013-01-31 | 44884.0 | 22910.0 | 21974.0 |

| 2013-02-28 | 50027.0 | 25898.0 | 24129.0 |

| ... | ... | ... | ... |

| 2023-04-30 | 60494.0 | 23784.0 | 36710.0 |

| 2023-05-31 | 105039.0 | 40303.0 | 64736.0 |

| 2023-06-30 | 102158.0 | 38076.0 | 64082.0 |

| 2023-07-31 | 112791.0 | 43064.0 | 69727.0 |

| 2023-08-31 | 108541.0 | 38967.0 | 69574.0 |

131 rows × 3 columns

Filtering time series

Source: https://pandas.pydata.org/docs/user_guide/timeseries.html#indexing

Using the index for time series provides us the advantage of being able to filter easily by year or month.

for example, you can do df.loc['2017'] to list all observations for 2017, or df.loc['2017-02'], or df.loc['2017-02-15'].

df.loc['2017-02-15']

| Total | East | West | |

|---|---|---|---|

| Date | |||

| 2017-02-15 00:00:00 | 4.0 | 3.0 | 1.0 |

| 2017-02-15 01:00:00 | 3.0 | 1.0 | 2.0 |

| 2017-02-15 02:00:00 | 0.0 | 0.0 | 0.0 |

| 2017-02-15 03:00:00 | 2.0 | 0.0 | 2.0 |

| 2017-02-15 04:00:00 | 2.0 | 1.0 | 1.0 |

| 2017-02-15 05:00:00 | 18.0 | 8.0 | 10.0 |

| 2017-02-15 06:00:00 | 60.0 | 45.0 | 15.0 |

| 2017-02-15 07:00:00 | 188.0 | 117.0 | 71.0 |

| 2017-02-15 08:00:00 | 262.0 | 152.0 | 110.0 |

| 2017-02-15 09:00:00 | 147.0 | 68.0 | 79.0 |

| 2017-02-15 10:00:00 | 49.0 | 25.0 | 24.0 |

| 2017-02-15 11:00:00 | 23.0 | 13.0 | 10.0 |

| 2017-02-15 12:00:00 | 12.0 | 7.0 | 5.0 |

| 2017-02-15 13:00:00 | 22.0 | 9.0 | 13.0 |

| 2017-02-15 14:00:00 | 17.0 | 2.0 | 15.0 |

| 2017-02-15 15:00:00 | 47.0 | 22.0 | 25.0 |

| 2017-02-15 16:00:00 | 99.0 | 29.0 | 70.0 |

| 2017-02-15 17:00:00 | 272.0 | 54.0 | 218.0 |

| 2017-02-15 18:00:00 | 181.0 | 48.0 | 133.0 |

| 2017-02-15 19:00:00 | 76.0 | 16.0 | 60.0 |

| 2017-02-15 20:00:00 | 43.0 | 14.0 | 29.0 |

| 2017-02-15 21:00:00 | 15.0 | 5.0 | 10.0 |

| 2017-02-15 22:00:00 | 16.0 | 6.0 | 10.0 |

| 2017-02-15 23:00:00 | 3.0 | 1.0 | 2.0 |

df.loc['2018']

| Total | East | West | |

|---|---|---|---|

| Date | |||

| 2018-01-01 00:00:00 | 28.0 | 14.0 | 14.0 |

| 2018-01-01 01:00:00 | 16.0 | 2.0 | 14.0 |

| 2018-01-01 02:00:00 | 8.0 | 4.0 | 4.0 |

| 2018-01-01 03:00:00 | 2.0 | 2.0 | 0.0 |

| 2018-01-01 04:00:00 | 0.0 | 0.0 | 0.0 |

| ... | ... | ... | ... |

| 2018-12-31 19:00:00 | 14.0 | 9.0 | 5.0 |

| 2018-12-31 20:00:00 | 26.0 | 12.0 | 14.0 |

| 2018-12-31 21:00:00 | 14.0 | 7.0 | 7.0 |

| 2018-12-31 22:00:00 | 7.0 | 3.0 | 4.0 |

| 2018-12-31 23:00:00 | 13.0 | 7.0 | 6.0 |

8759 rows × 3 columns

df.loc['2018-02']

| Total | East | West | |

|---|---|---|---|

| Date | |||

| 2018-02-01 00:00:00 | 8.0 | 2.0 | 6.0 |

| 2018-02-01 01:00:00 | 3.0 | 2.0 | 1.0 |

| 2018-02-01 02:00:00 | 0.0 | 0.0 | 0.0 |

| 2018-02-01 03:00:00 | 6.0 | 3.0 | 3.0 |

| 2018-02-01 04:00:00 | 8.0 | 5.0 | 3.0 |

| ... | ... | ... | ... |

| 2018-02-28 19:00:00 | 77.0 | 17.0 | 60.0 |

| 2018-02-28 20:00:00 | 35.0 | 7.0 | 28.0 |

| 2018-02-28 21:00:00 | 32.0 | 14.0 | 18.0 |

| 2018-02-28 22:00:00 | 13.0 | 2.0 | 11.0 |

| 2018-02-28 23:00:00 | 9.0 | 3.0 | 6.0 |

672 rows × 3 columns

You can also use the regular methods for filtering date ranges

df[(df.index > pd.to_datetime('1/31/2020')) & (df.index < pd.to_datetime('1/1/2022'))]

| Total | East | West | |

|---|---|---|---|

| Date | |||

| 2020-01-31 01:00:00 | 1.0 | 0.0 | 1.0 |

| 2020-01-31 02:00:00 | 0.0 | 0.0 | 0.0 |

| 2020-01-31 03:00:00 | 0.0 | 0.0 | 0.0 |

| 2020-01-31 04:00:00 | 8.0 | 6.0 | 2.0 |

| 2020-01-31 05:00:00 | 14.0 | 7.0 | 7.0 |

| ... | ... | ... | ... |

| 2021-12-31 19:00:00 | 0.0 | 0.0 | 0.0 |

| 2021-12-31 20:00:00 | 0.0 | 0.0 | 0.0 |

| 2021-12-31 21:00:00 | 0.0 | 0.0 | 0.0 |

| 2021-12-31 22:00:00 | 0.0 | 0.0 | 0.0 |

| 2021-12-31 23:00:00 | 0.0 | 0.0 | 0.0 |

16821 rows × 3 columns

Sometimes, the date may be contained in a column.

In such cases, we filter as follows:

# We create a temporary dataframe to illustrate

temporary_df = df.loc['2017-01'].copy()

temporary_df.reset_index(inplace = True)

temporary_df

| Date | Total | East | West | |

|---|---|---|---|---|

| 0 | 2017-01-01 00:00:00 | 5.0 | 0.0 | 5.0 |

| 1 | 2017-01-01 01:00:00 | 19.0 | 5.0 | 14.0 |

| 2 | 2017-01-01 02:00:00 | 1.0 | 1.0 | 0.0 |

| 3 | 2017-01-01 03:00:00 | 2.0 | 0.0 | 2.0 |

| 4 | 2017-01-01 04:00:00 | 1.0 | 0.0 | 1.0 |

| ... | ... | ... | ... | ... |

| 739 | 2017-01-31 19:00:00 | 116.0 | 27.0 | 89.0 |

| 740 | 2017-01-31 20:00:00 | 64.0 | 25.0 | 39.0 |

| 741 | 2017-01-31 21:00:00 | 32.0 | 19.0 | 13.0 |

| 742 | 2017-01-31 22:00:00 | 19.0 | 4.0 | 15.0 |

| 743 | 2017-01-31 23:00:00 | 15.0 | 6.0 | 9.0 |

744 rows × 4 columns

temporary_df['Date'].dt.day==2

0 False

1 False

2 False

3 False

4 False

...

739 False

740 False

741 False

742 False

743 False

Name: Date, Length: 744, dtype: bool

temporary_df[temporary_df['Date'].dt.month == 1]

# or use temporary_df['Date'].dt.day and year as well

| Date | Total | East | West | |

|---|---|---|---|---|

| 0 | 2017-01-01 00:00:00 | 5.0 | 0.0 | 5.0 |

| 1 | 2017-01-01 01:00:00 | 19.0 | 5.0 | 14.0 |

| 2 | 2017-01-01 02:00:00 | 1.0 | 1.0 | 0.0 |

| 3 | 2017-01-01 03:00:00 | 2.0 | 0.0 | 2.0 |

| 4 | 2017-01-01 04:00:00 | 1.0 | 0.0 | 1.0 |

| ... | ... | ... | ... | ... |

| 739 | 2017-01-31 19:00:00 | 116.0 | 27.0 | 89.0 |

| 740 | 2017-01-31 20:00:00 | 64.0 | 25.0 | 39.0 |

| 741 | 2017-01-31 21:00:00 | 32.0 | 19.0 | 13.0 |

| 742 | 2017-01-31 22:00:00 | 19.0 | 4.0 | 15.0 |

| 743 | 2017-01-31 23:00:00 | 15.0 | 6.0 | 9.0 |

744 rows × 4 columns

Plot by month and quarter

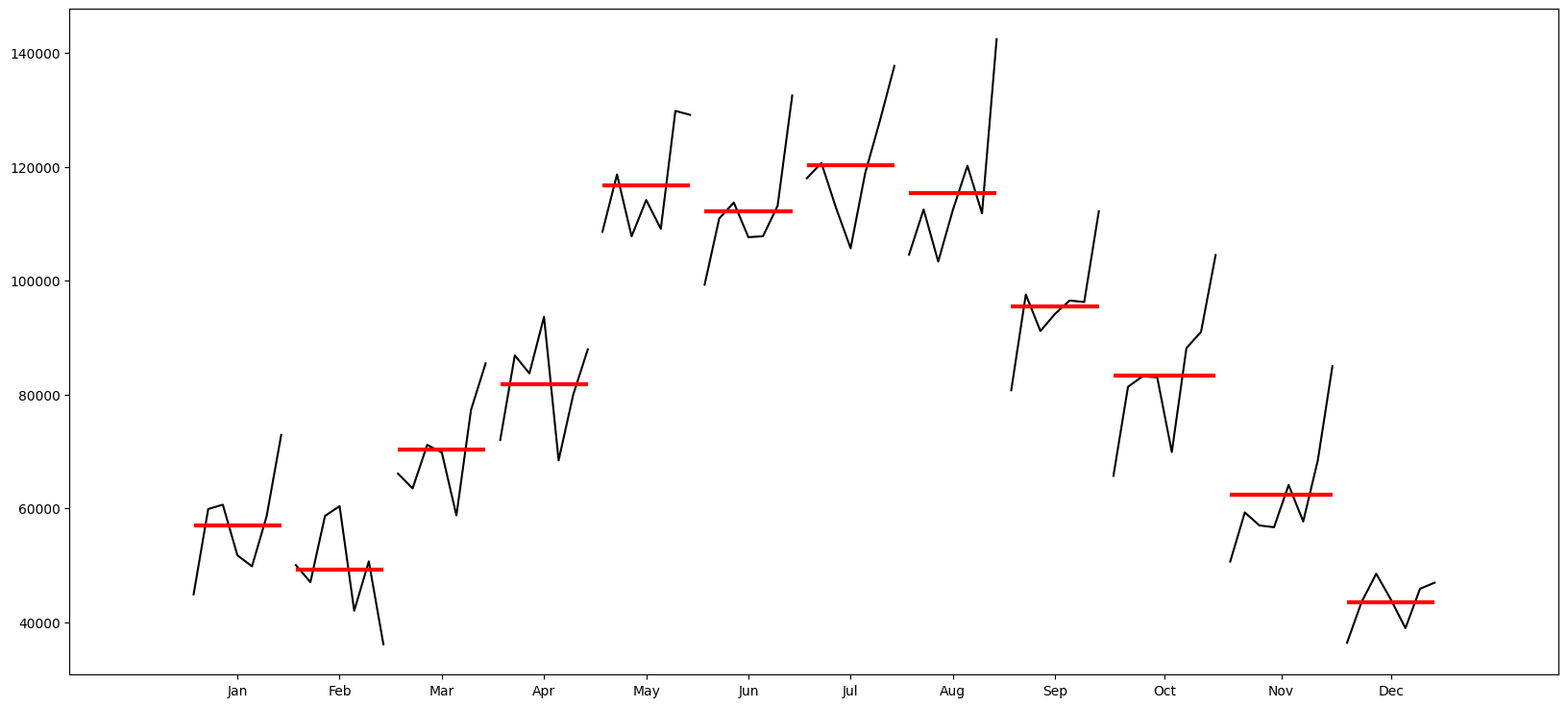

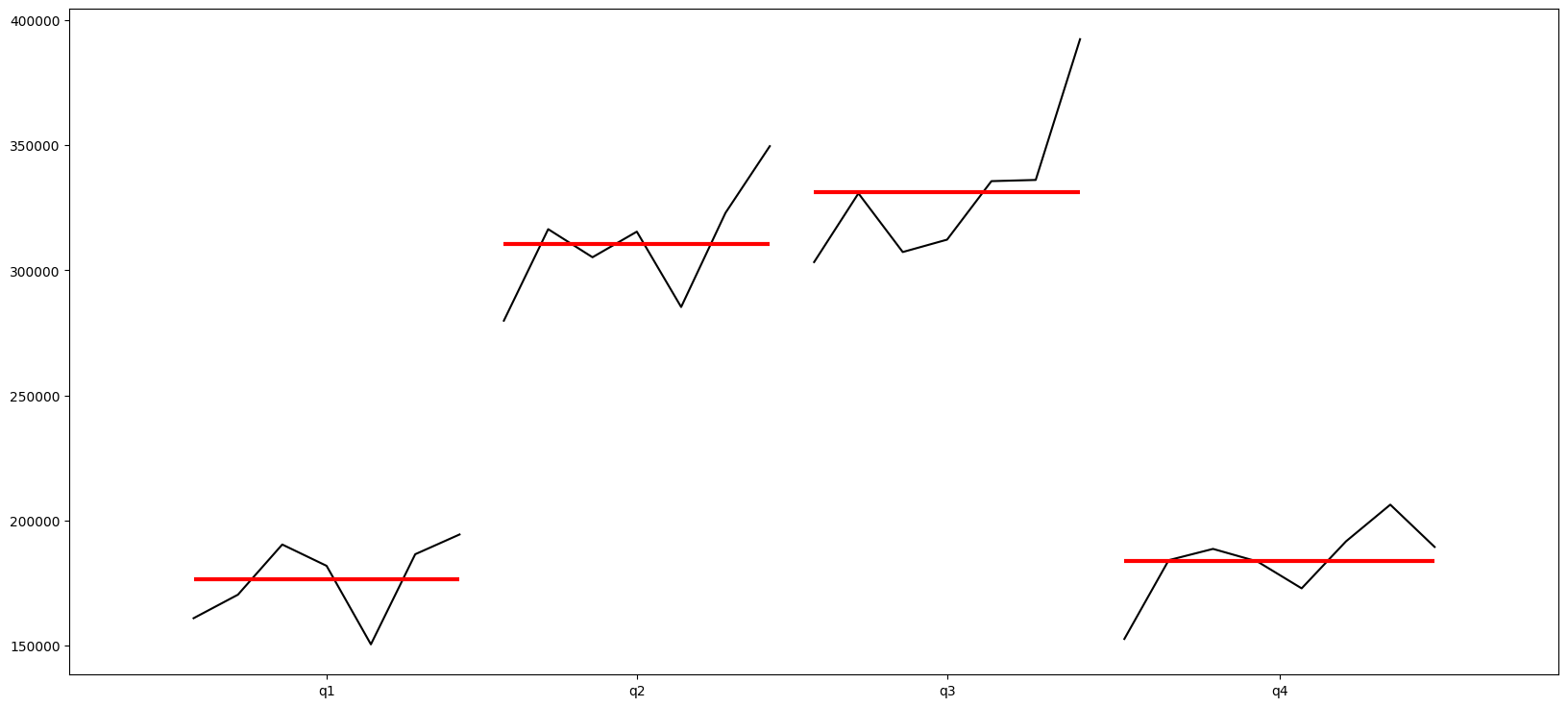

from statsmodels.graphics.tsaplots import month_plot, quarter_plot

# Plot the months to see trends over months

month_plot(df_precovid.Total);

# Plot the quarter to see trends over quarters

quarter_plot(df_precovid.resample(rule='Q').Total.sum());

ETS Decomposition

When we decompose a time series, we are essentially expressing a belief that our data has several discrete components to it, each which can be isolated and studied separately.

Generally, time series data is split into 3 components: error, trend and seasonality (hence ‘ETS Decomposition’):

1. Seasonal component

2. Trend/cycle component

2. Residual, or error component which is not explained by the above two.

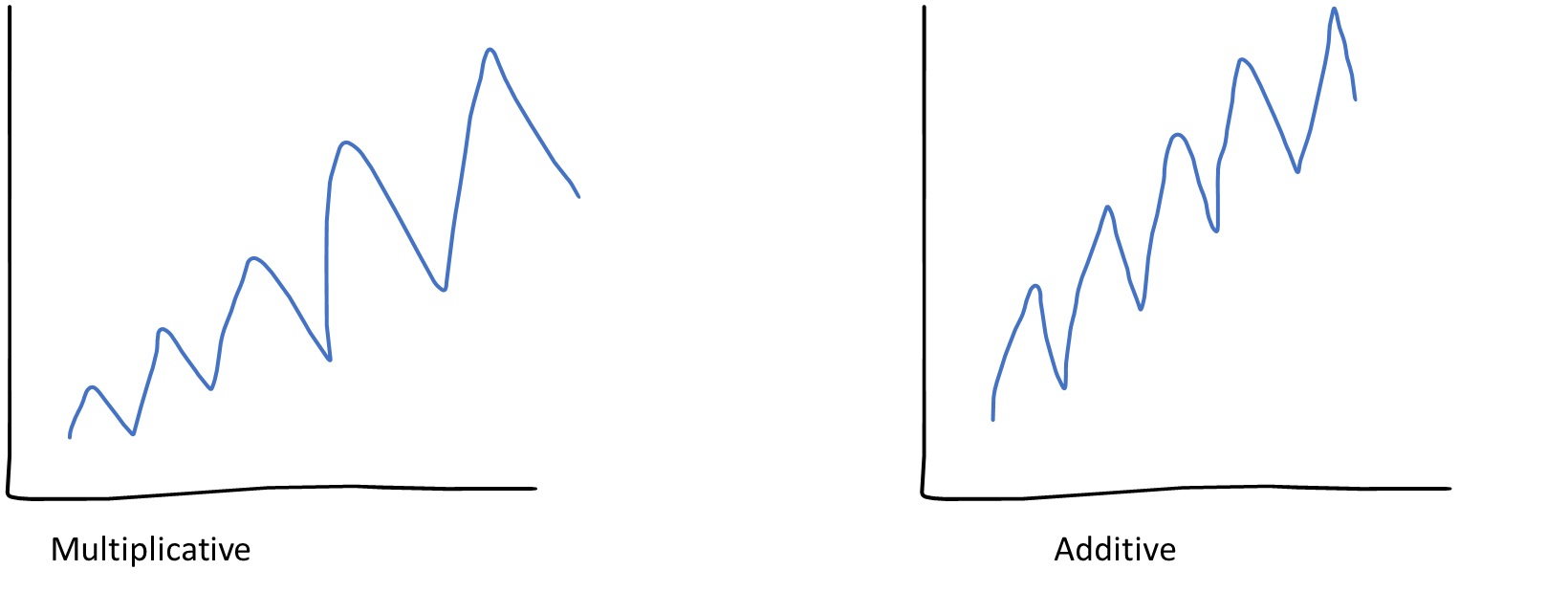

Multiplicative vs Additive Decomposition

If we assume an additive decomposition, then we can write:

where is the data,

- is the seasonal component,

- is the trend-cycle component, and

- is the remainder component

at time period .

A multiplicative decomposition would be similarly written

The additive decomposition is the most appropriate if the magnitude of the seasonal fluctuations, or the variation around the trend-cycle, does not vary with the level of the time series.

When the variation in the seasonal pattern, or the variation around the trend-cycle, appears to be proportional to the level of the time series, then a multiplicative decomposition is more appropriate. Multiplicative decompositions are common with economic time series.

- Components are additive when the components do not change over time, and

- Components are multiplicative when their levels are changing with time.

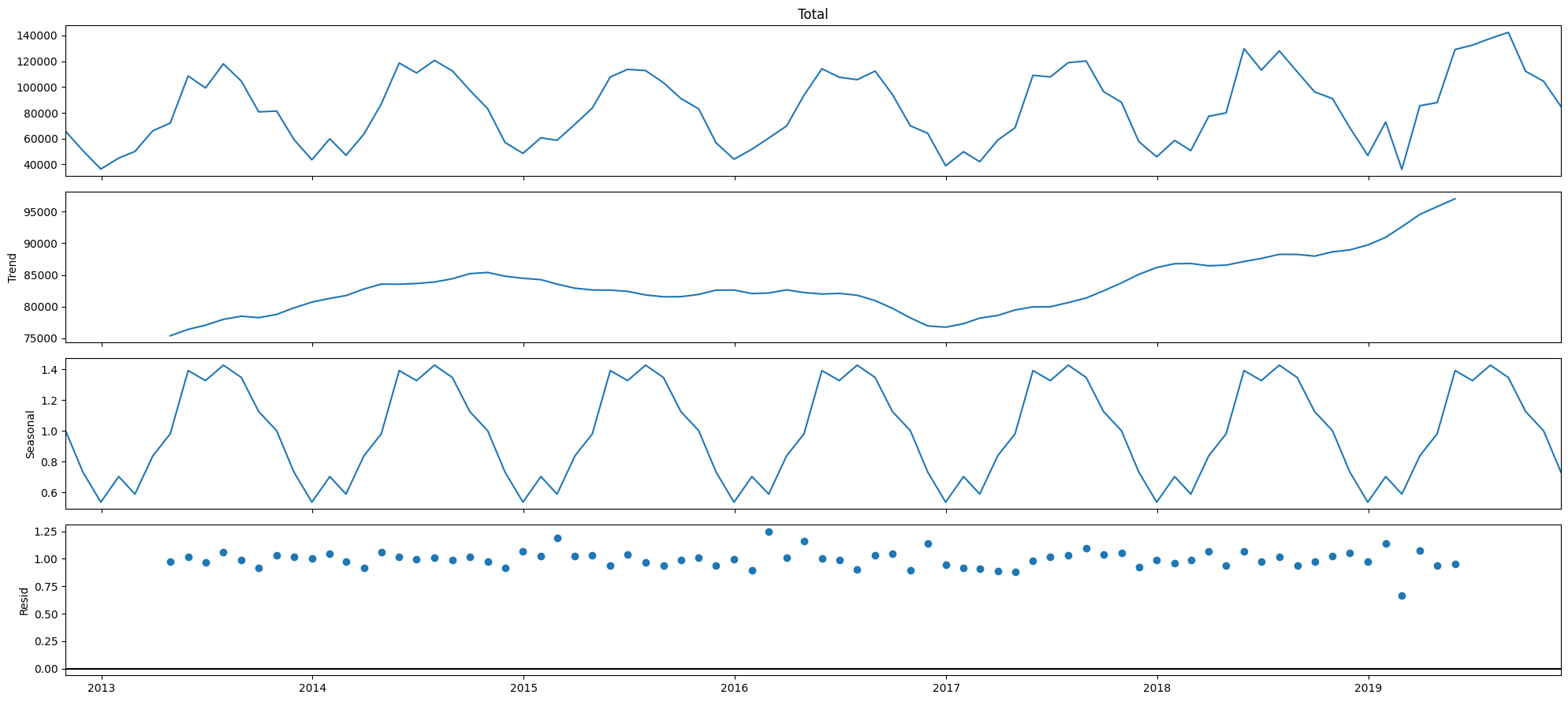

Multiplicative

The Statsmodels library gives us the functionality to decompose time series. Below, we decompose the time series using multiplicative decomposition. Let us spend a couple of moments looking at the chart below. Note that the first panel, ‘Total’, is the sum of the other three, ie Trend, Seasonal and Resid.

# Now we decompose our time series

import matplotlib.pyplot as plt

from statsmodels.tsa.seasonal import seasonal_decompose

# We use the multiplicative model

result = seasonal_decompose(df_precovid['Total'], model = 'multiplicative')

plt.rcParams['figure.figsize'] = (20, 9)

result.plot();

# Each of the above components are contained in our `result`

# object as trend, seasonal and error.

# Let us put them in a dataframe

ets = pd.DataFrame({'Total': df_precovid['Total'],

'trend': result.trend,

'seasonality': result.seasonal,

'error': result.resid}).head(20)

# ets.to_excel('ets_mul.xlsx')

ets

| Total | trend | seasonality | error | |

|---|---|---|---|---|

| Date | ||||

| 2012-10-31 | 65695.0 | NaN | 1.001160 | NaN |

| 2012-11-30 | 50647.0 | NaN | 0.731912 | NaN |

| 2012-12-31 | 36369.0 | NaN | 0.536130 | NaN |

| 2013-01-31 | 44884.0 | NaN | 0.702895 | NaN |

| 2013-02-28 | 50027.0 | NaN | 0.588604 | NaN |

| 2013-03-31 | 66089.0 | NaN | 0.837828 | NaN |

| 2013-04-30 | 71998.0 | 75386.958333 | 0.980757 | 0.973785 |

| 2013-05-31 | 108574.0 | 76398.625000 | 1.392398 | 1.020650 |

| 2013-06-30 | 99280.0 | 77057.250000 | 1.327268 | 0.970710 |

| 2013-07-31 | 117974.0 | 77981.125000 | 1.427836 | 1.059543 |

| 2013-08-31 | 104549.0 | 78480.583333 | 1.347373 | 0.988712 |

| 2013-09-30 | 80729.0 | 78247.375000 | 1.125840 | 0.916396 |

| 2013-10-31 | 81352.0 | 78758.291667 | 1.001160 | 1.031736 |

| 2013-11-30 | 59270.0 | 79796.916667 | 0.731912 | 1.014822 |

| 2013-12-31 | 43553.0 | 80700.958333 | 0.536130 | 1.006629 |

| 2014-01-31 | 59873.0 | 81297.708333 | 0.702895 | 1.047762 |

| 2014-02-28 | 47025.0 | 81740.875000 | 0.588604 | 0.977386 |

| 2014-03-31 | 63494.0 | 82772.958333 | 0.837828 | 0.915565 |

| 2014-04-30 | 86855.0 | 83550.500000 | 0.980757 | 1.059948 |

| 2014-05-31 | 118644.0 | 83531.833333 | 1.392398 | 1.020071 |

# Check if things work in the multiplicative model

print('Total = ', 71998.0)

print('Trend * Factor for Seasonality * Factor for Error =',75386.958333 * 0.980757 * 0.973785)

Total = 71998.0

Trend * Factor for Seasonality * Factor for Error = 71998.04732763417

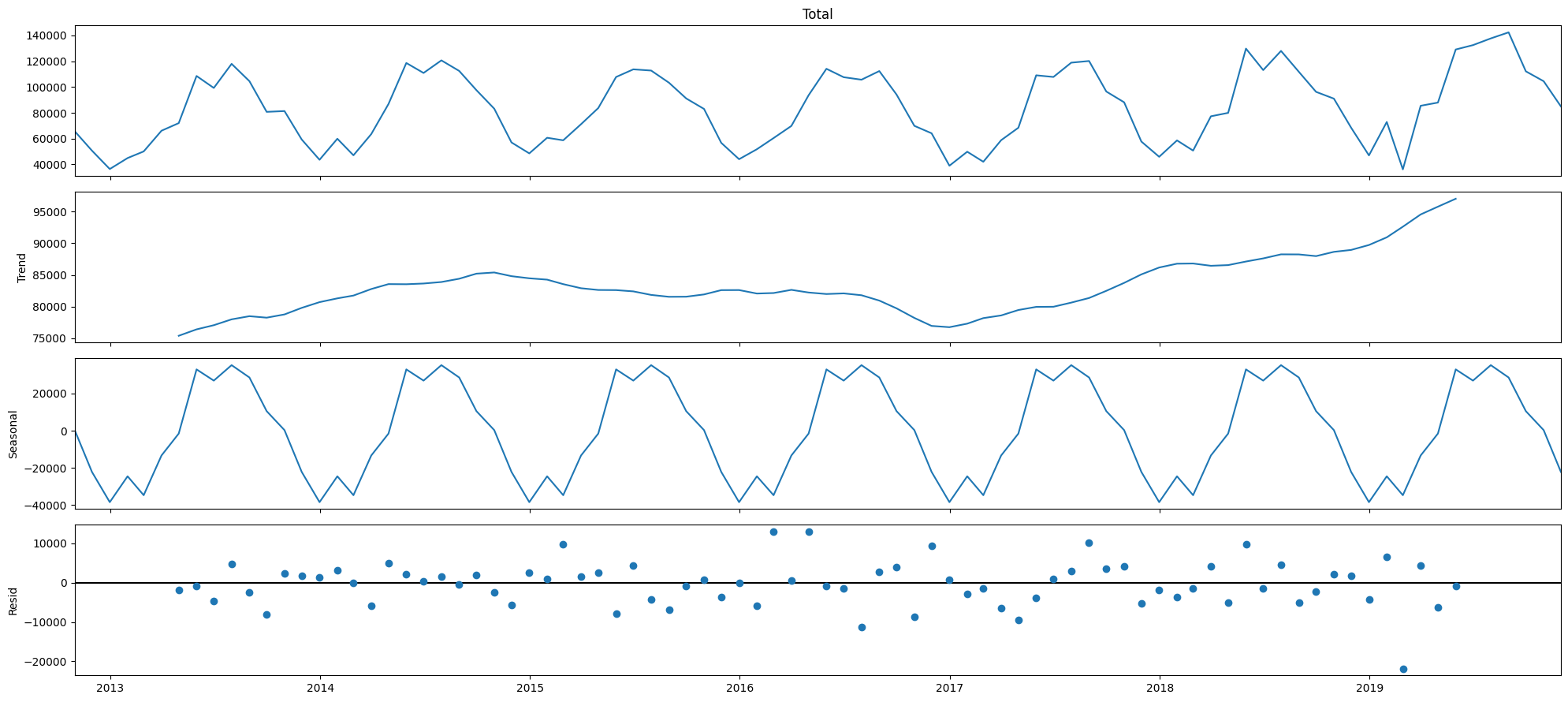

Additive

We do the same thing as before, except that we change the model to be additive.

result = seasonal_decompose(df_precovid['Total'], model = 'additive')

plt.rcParams['figure.figsize'] = (20, 9)

result.plot();

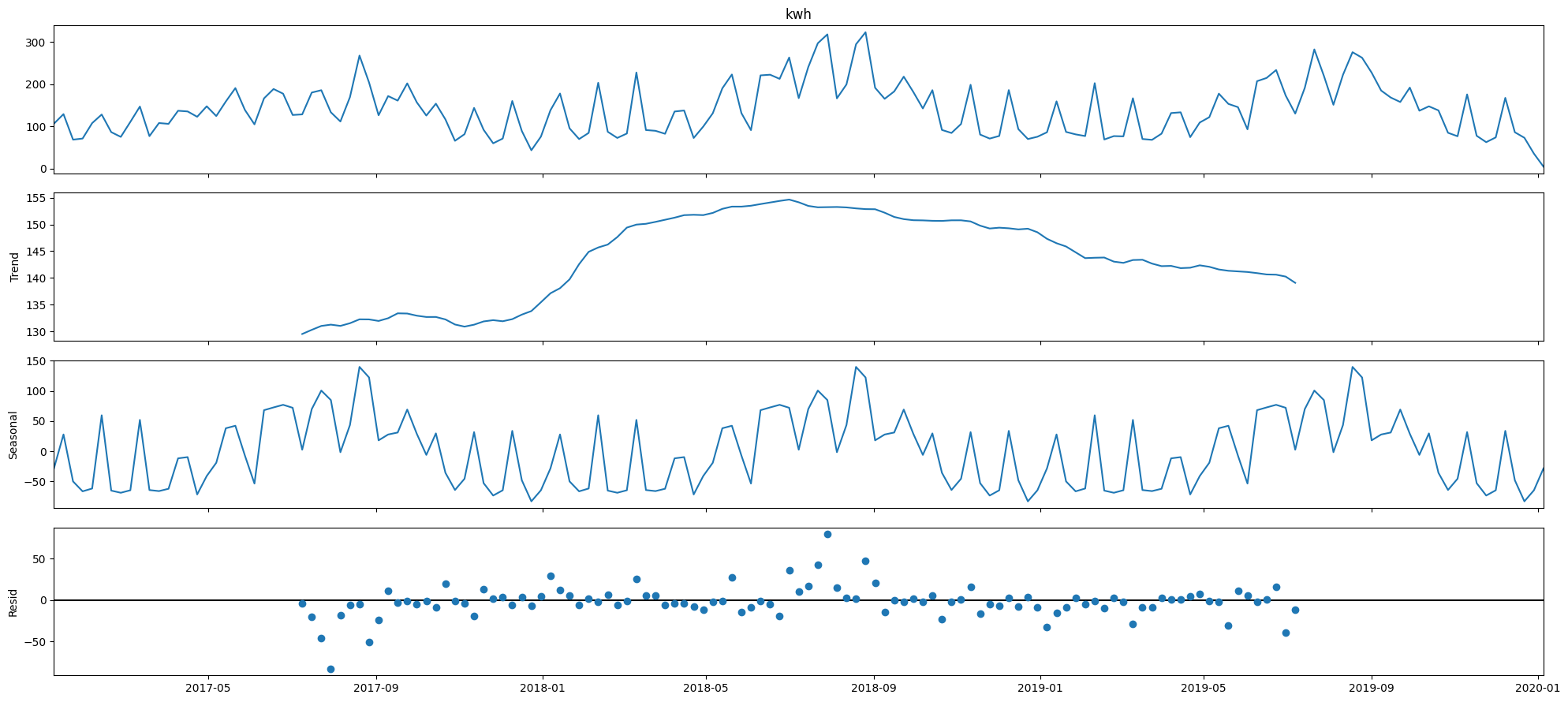

Here, an additive model seems to make sense. This is because the residuals seem to be better centered around zero.

Obtaining the components numerically

While this is great from a visual or graphical perspective, sometimes we may need to get the actual numbers for the three decomposed components. We can do so easily - the code below provides us this data in a dataframe.

# Each of the above components are contained in our `result`

# object as trend, seasonal and error.

# Let us put them in a dataframe

ets = pd.DataFrame({'Total': df_precovid['Total'],

'trend': result.trend,

'seasonality': result.seasonal,

'error': result.resid}).head(20)

# ets.to_excel('ets_add.xlsx')

ets

| Total | trend | seasonality | error | |

|---|---|---|---|---|

| Date | ||||

| 2012-10-31 | 65695.0 | NaN | 315.920635 | NaN |

| 2012-11-30 | 50647.0 | NaN | -22171.933532 | NaN |

| 2012-12-31 | 36369.0 | NaN | -38436.746032 | NaN |

| 2013-01-31 | 44884.0 | NaN | -24517.440476 | NaN |

| 2013-02-28 | 50027.0 | NaN | -34696.308532 | NaN |

| 2013-03-31 | 66089.0 | NaN | -13329.627976 | NaN |

| 2013-04-30 | 71998.0 | 75386.958333 | -1536.224206 | -1852.734127 |

| 2013-05-31 | 108574.0 | 76398.625000 | 32985.115079 | -809.740079 |

| 2013-06-30 | 99280.0 | 77057.250000 | 26951.087302 | -4728.337302 |

| 2013-07-31 | 117974.0 | 77981.125000 | 35276.733135 | 4716.141865 |

| 2013-08-31 | 104549.0 | 78480.583333 | 28635.517857 | -2567.101190 |

| 2013-09-30 | 80729.0 | 78247.375000 | 10523.906746 | -8042.281746 |

| 2013-10-31 | 81352.0 | 78758.291667 | 315.920635 | 2277.787698 |

| 2013-11-30 | 59270.0 | 79796.916667 | -22171.933532 | 1645.016865 |

| 2013-12-31 | 43553.0 | 80700.958333 | -38436.746032 | 1288.787698 |

| 2014-01-31 | 59873.0 | 81297.708333 | -24517.440476 | 3092.732143 |

| 2014-02-28 | 47025.0 | 81740.875000 | -34696.308532 | -19.566468 |

| 2014-03-31 | 63494.0 | 82772.958333 | -13329.627976 | -5949.330357 |

| 2014-04-30 | 86855.0 | 83550.500000 | -1536.224206 | 4840.724206 |

| 2014-05-31 | 118644.0 | 83531.833333 | 32985.115079 | 2127.051587 |

ets.describe()

| Total | trend | seasonality | error | |

|---|---|---|---|---|

| count | 20.000000 | 14.000000 | 20.000000 | 14.000000 |

| mean | 72844.050000 | 79692.997024 | -5069.362252 | -284.346372 |

| std | 25785.957067 | 2640.000168 | 25620.440647 | 3935.011207 |

| min | 36369.000000 | 75386.958333 | -38436.746032 | -8042.281746 |

| 25% | 50492.000000 | 78047.687500 | -24517.440476 | -2388.509425 |

| 50% | 65892.000000 | 79277.604167 | -7432.926091 | 634.610615 |

| 75% | 89961.250000 | 81630.083333 | 14630.701885 | 2240.103671 |

| max | 118644.000000 | 83550.500000 | 35276.733135 | 4840.724206 |

What is this useful for?

- Time series decomposition is primarily useful for studying time series data, and exploring historical trends over time.

- It is also useful for calculating 'seasonally adjusted' numbers, which is really just the trend number. The trend has no seasonality.

- Seasonally adjusted number =

- Note that seasons are different from cycles. Cycles have no fixed length, and we can never be sure of when they begin, peak and end. The timing of cycles is unpredictable.

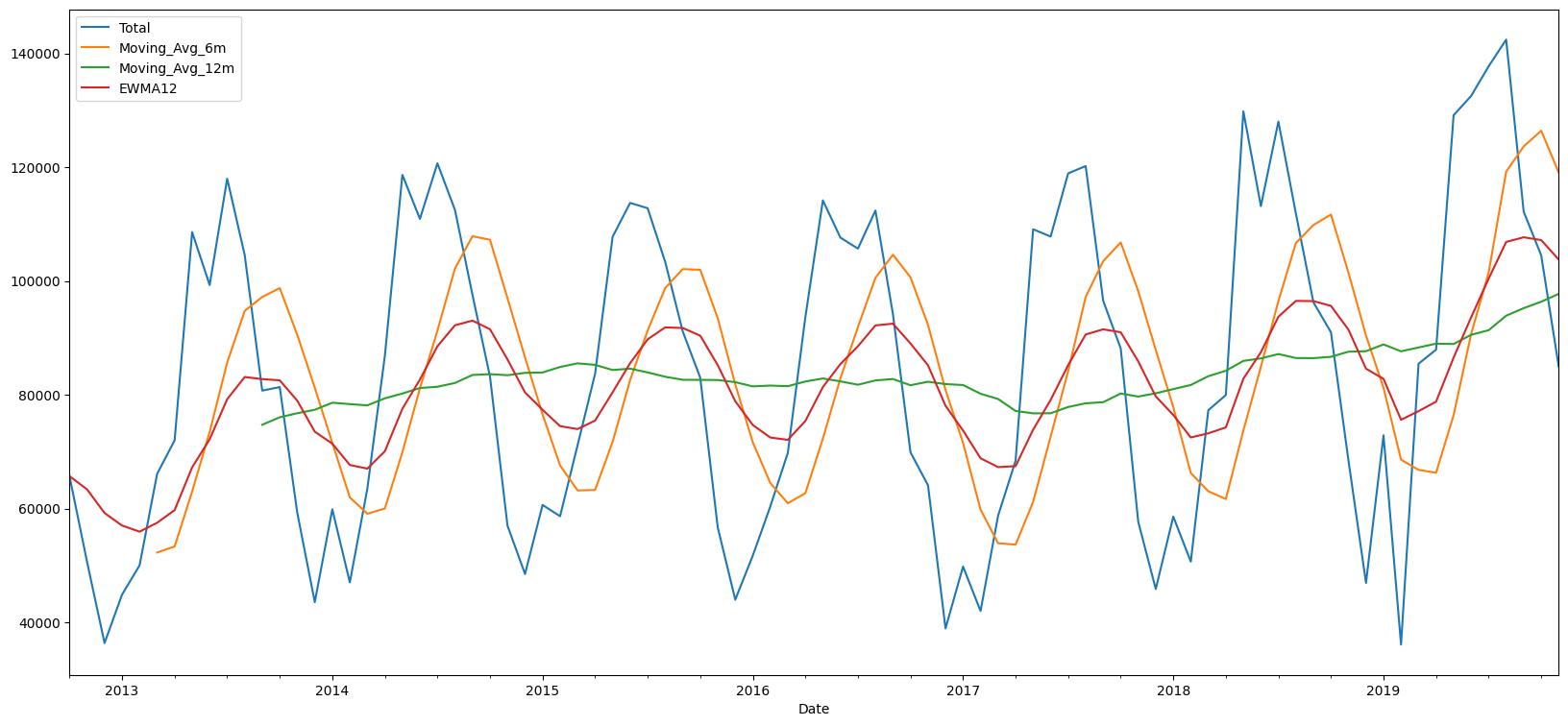

Moving Average and Exponentially Weighted Moving Average

Moving averages are an easy way to understand and describe time series.

By using a sliding window along which observations are averaged, they can suppress seasonality and noise, and expose the trend.

Moving averages are not generally used for forecasting, and don’t inform us about the future behavior of our time series. Their huge advantage is they are simple to understand, and explain, and get to a high level view of what is in the data.

Simple Moving Averages

Simple moving averages (SMA) tend to even out seasonality, and offer an easy way to examine the trend. Consider the 6 month and 12 month moving averages in the graphic below. SMAs are difficult to use for forecasting, and will lag by the window size.

Exponentially Weighted Moving Average (EWMA)

EWMA is a more advanced method than SMA, and puts more weight on values that occurred more recently. Forecasts produced using exponential smoothing methods are weighted averages of past observations, with the weights decaying exponentially as the observations get older. The more recent the observation, the higher the associated weight.

This framework generates reliable forecasts quickly and for a wide range of time series, which is a great advantage and of major importance to applications in industry.

EWMA can be easily calculated using the ewm() function in pandas. The parameter adjust controls how the EWMA term is calculated.

-

When

adjust=True(default), the EW function is calculated using weights . For example, the EW moving average of the series [] would be: -

When

adjust=False, the exponentially weighted function is calculated recursively:

\end{split}

(Source: Pandas documentation at https://pandas.pydata.org/docs/reference/api/pandas.DataFrame.ewm.html)

The alpha parameter can be specified in the formula in one of four ways:

- Alpha specifies the smoothing factor directly. Specify smoothing factor directly

- Span corresponds to what is commonly called an "N-day Exponentially Weighted Moving Average". Specify decay in terms of span

, for .

- COM (Center of mass): Specify decay in terms of center of mass

, for .

- Half-life is the period of time for the exponential weight to reduce to one half. Specify decay in terms of half-life

, for . If times is specified, the time unit (str or timedelta) over which an observation decays to half its value. Only applicable to mean(), and halflife value will not apply to the other functions.

.

# let us look at rolling averages & EWM together

new_df = df_precovid[['Total']]

new_df['Moving_Avg_6m'] = new_df['Total'].rolling(window=6).mean()

new_df['Moving_Avg_12m'] = new_df['Total'].rolling(window=12).mean()

new_df['EWMA12'] = new_df['Total'].ewm(span=12,adjust=False).mean()

# Note that available EW functions include mean(), var(), std(), corr(), cov().

new_df.plot();

# new_df.to_excel('temp.xlsx')

2/(12+1)

0.15384615384615385

In the graph above, the red line is the EWMA with span=12, or alpha=2/(12+1) ≈ 0.15.

EWMA has a single smoothing parameter, , and does not account for seasonality or trend. It is only suitable for data with no clear trend or seasonal pattern.

Note that we haven’t talked about forecasting yet – that comes next. We have so far only ‘fitted’ the EWMA model to a given time series. Know that EWMA is just a weighted average, with more (or less, depending on alpha) weight to recent observations.

Stationarity

What is Stationarity?

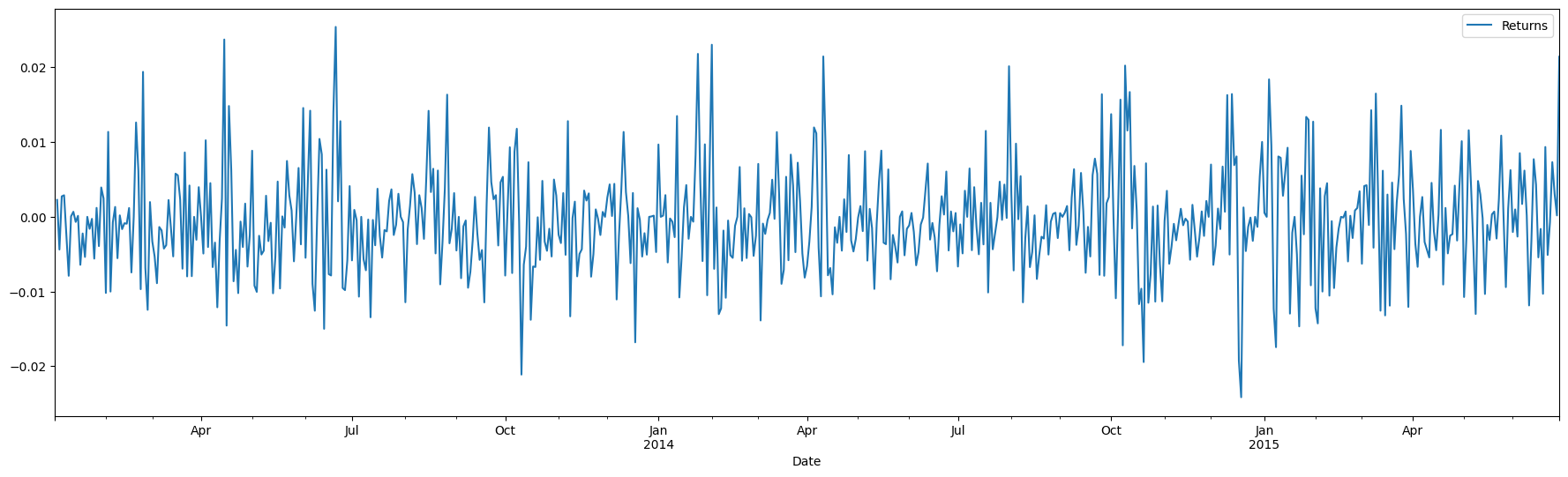

A stationary series has constant mean and variance over time. Which means there is no trend, and no seasonality either. Stationarity is important for forecasting time series because if the mean and variance are changing with the passage of time, any estimates using a regression model will start to drift very quickly as we forecast into the future.

If a time series is not stationary, we need to ‘difference’ it with itself so it becomes stationary. Differencing means you subtract the previous observation from the current observation.

How do we know if a series is stationary?

- We can examine stationarity by visually inspecting the time series.

- Or, we can run a statistical test (The Augmented Dickey-Fuller test) to check for stationarity.

Fortunately, an ARIMA model takes care of most issues with non-stationarity for us and we do not need to adjust it. However, if we are using ARMA, we do need to ensure that our series is stationary.

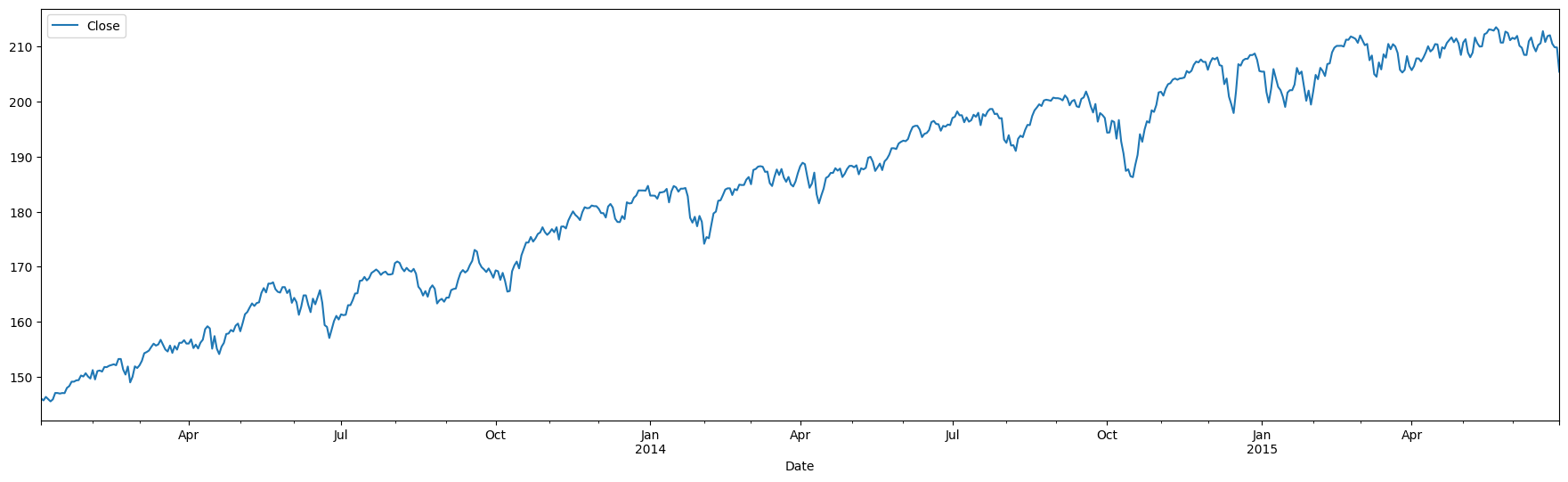

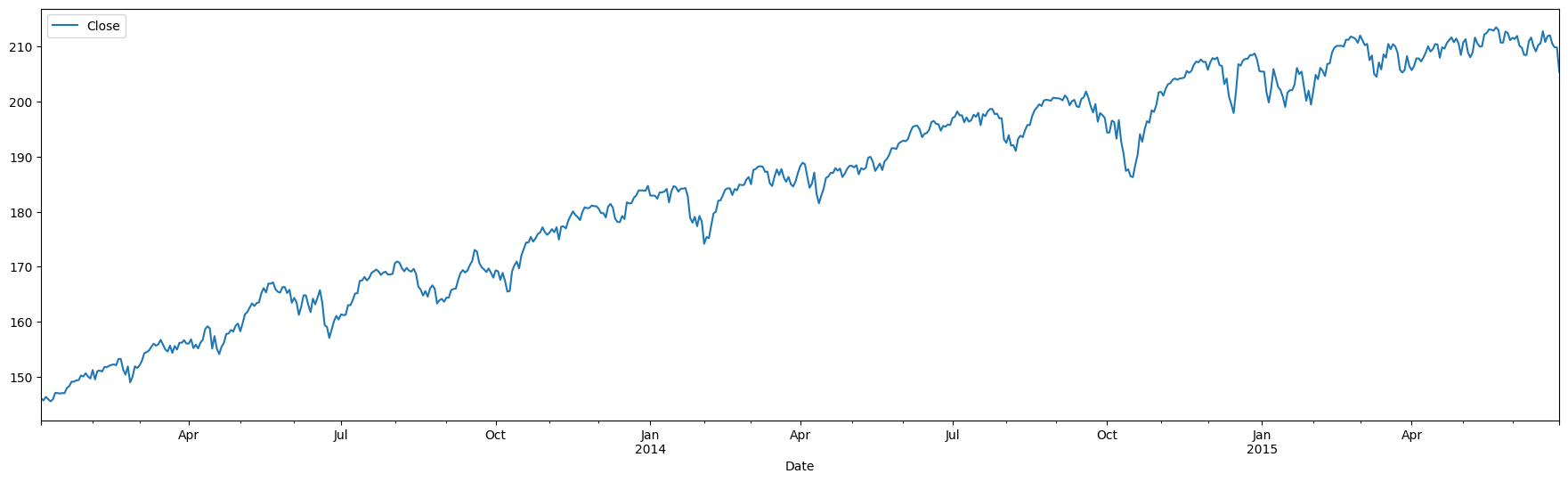

Let us look at two real time series to get a sense of stationarity. We import some stock price data, and also look at stock price returns. We just pick the S&P500 index, though we could have picked any listed company.

# Let us get some data. We download the daily time series for the S&P500 for 30 months

import yfinance as yf

SPY = yf.download('SPY', start = '2013-01-01', end = '2015-06-30')

[*********************100%%**********************] 1 of 1 completed

# Clean up

SPY.index = pd.DatetimeIndex(SPY.index) # Set index

SPY = SPY.asfreq('B') # This creates rows for any missing dates

SPY.fillna(method = 'bfill', inplace=True) # Fills missing dates with last observation

SPY.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 649 entries, 2013-01-02 to 2015-06-29

Freq: B

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 649 non-null float64

1 High 649 non-null float64

2 Low 649 non-null float64

3 Close 649 non-null float64

4 Adj Close 649 non-null float64

5 Volume 649 non-null float64

dtypes: float64(6)

memory usage: 35.5 KB

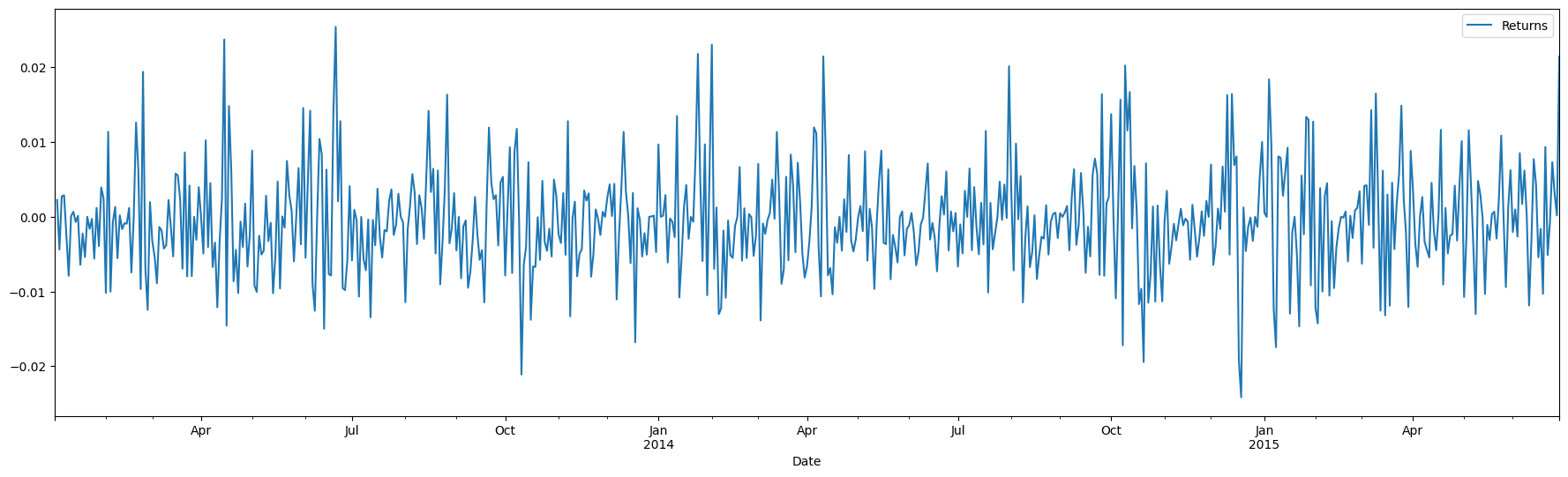

Example of stationary vs non-stationary time series

The top panel shows stock returns, that appear to have a mean close to zero. The bottom is stock prices, which appear to have a trend

SPY['Returns'] = (SPY['Close'].shift(1) / SPY['Close']) - 1

SPY[['Returns']].plot(figsize = (22,6));

SPY[['Close']].plot(figsize = (22,6));

Making a series stationary

If data is not stationary, ‘differencing’ can make it stationary. Differencing is subtracting the prior observation from the current one.

If the differenced time series is not stationary either, we can continue differencing till we get to a stationary time series.

The number of times we have to difference a time series to get to stationarity is the ‘order’ of differencing. This reflects the parameter in ARIMA.

We can difference a series using Pandas series.diff() function, however there are libraries available that will automatically use an appropriate value for the parameter d.

Dickey Fuller Test for Stationarity

We can run the Dickey Fuller test for stationarity - If p-value > 0.05, we decide that the dataset is not stationary. Let us run this test against our stock price time series.

When we run this test in Python, we get a cryptic output in the form of a tuple. The help text for this function shows the complete explanation for how to interpret the results:

Returns

-------

adf : float

The test statistic.

pvalue : float

MacKinnon's approximate p-value based on MacKinnon (1994, 2010).

usedlag : int

The number of lags used.

nobs : int

The number of observations used for the ADF regression and calculation

of the critical values.

critical values : dict

Critical values for the test statistic at the 1 %, 5 %, and 10 %

levels. Based on MacKinnon (2010).

icbest : float

The maximized information criterion if autolag is not None.

resstore : ResultStore, optional

A dummy class with results attached as attributes.

For us, the second value is the p-value that we are interested in. If this is > 0.05, we decide the series is not stationary.

# Test the stock price data

from statsmodels.tsa.stattools import adfuller

adfuller(SPY['Close'])

(-1.6928673813673563,

0.4347911128784576,

0,

648,

{'1%': -3.4404817800778034,

'5%': -2.866010569916275,

'10%': -2.569150763698369},

2126.1002309138994)

# Test the stock returns data

adfuller(SPY['Returns'].dropna())

(-26.546757517762995,

0.0,

0,

647,

{'1%': -3.4404975024933813,

'5%': -2.8660174956716795,

'10%': -2.569154453750397},

-4424.286299515888)

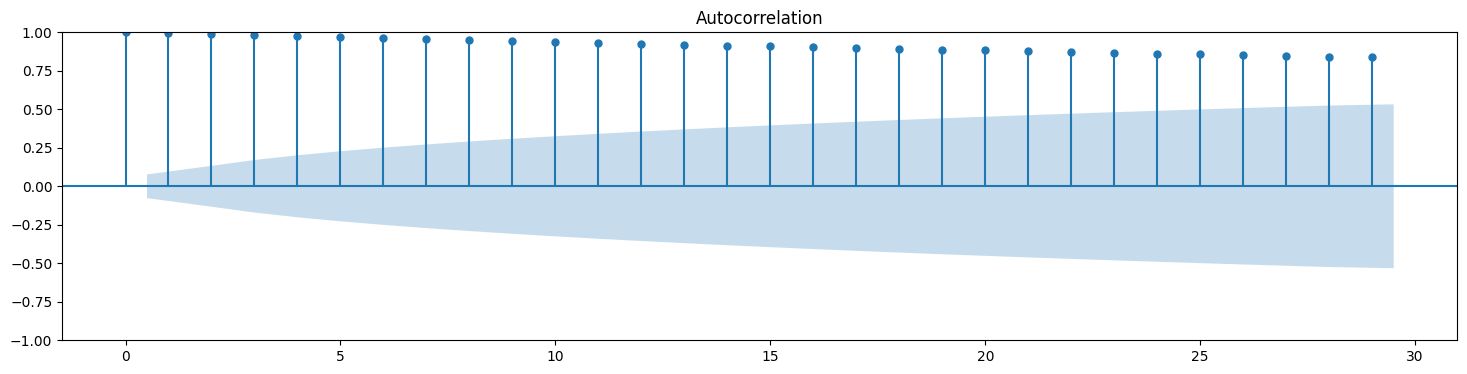

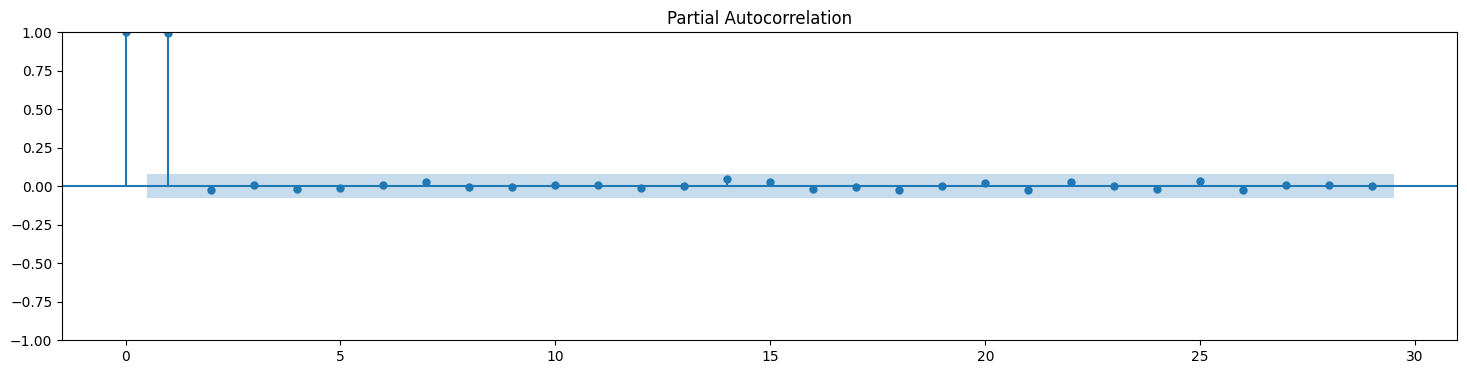

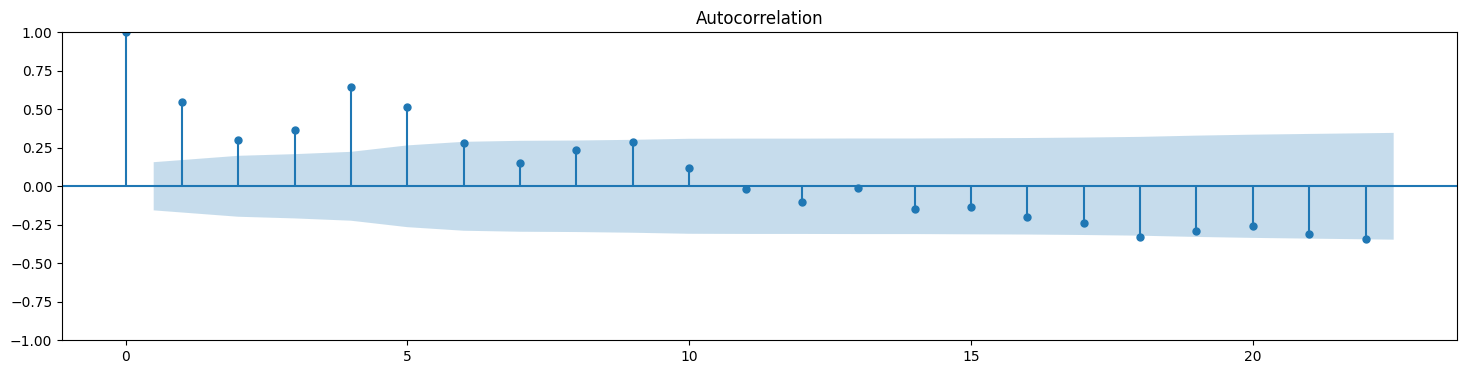

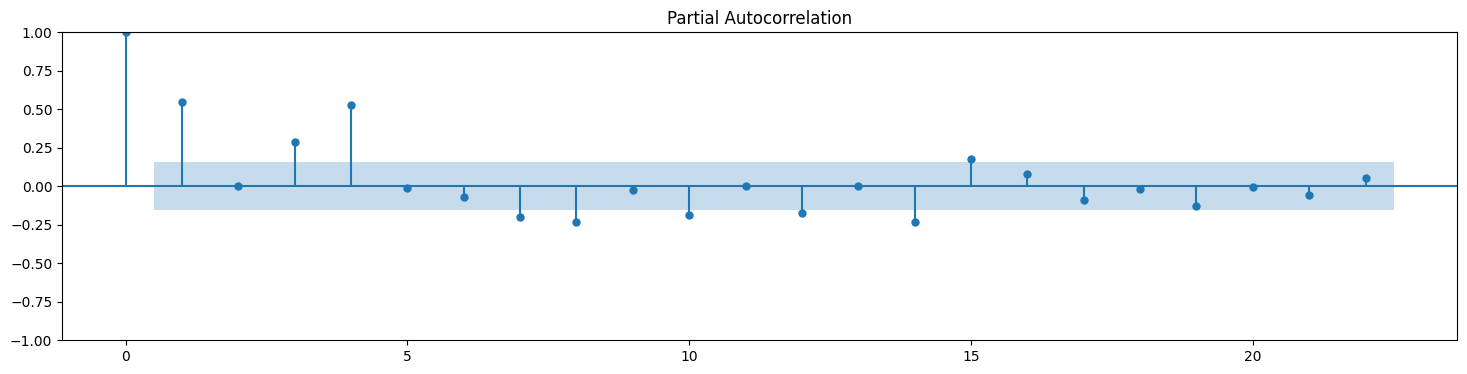

Auto-Correlation and Partial Auto-Correlation (ACF and PACF plots)

Autocorrelation in a time series is the correlation of an observation to the observations that precede it. Autocorrelation is the basis for being able to use auto regression to forecast a time series.

To calculate autocorrelation for a series, we shift the series by one step, and calculate the correlation between the two. We keep increasing the number of steps to see correlations with past periods.

Fortunately, libraries exist that allow us to do these tedious calculations and present a tidy graph.

Next, we will look at Autocorrelation plots for both our stock price series, and also the total number of bicycle crossings in Seattle.

# Autocorrelation and partial autocorrelation plots for stock prices

plt.rc("figure", figsize=(18,4))

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf

plot_acf(SPY['Close']);

plot_pacf(SPY['Close']);

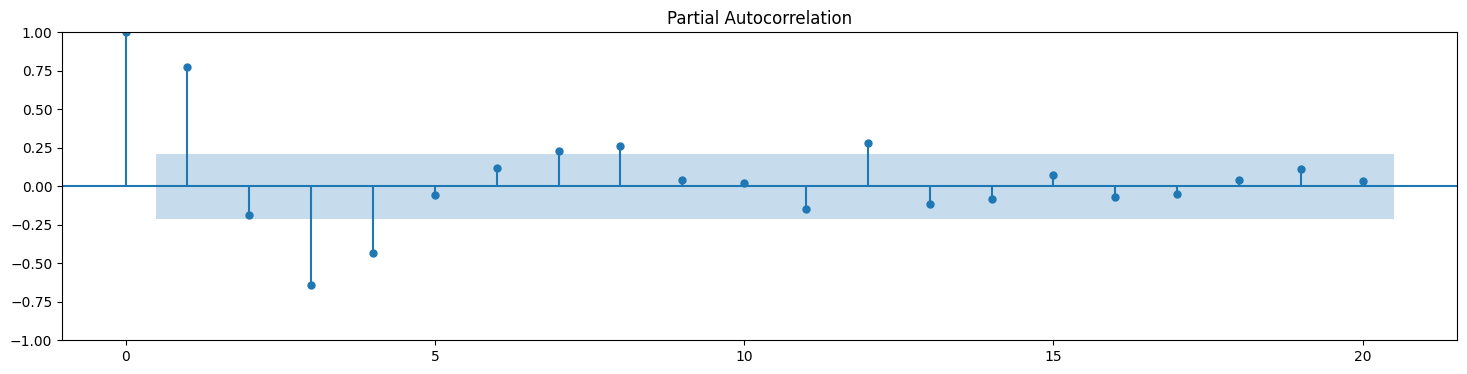

The shaded area represents the 95% confidence level.

PACF for ARIMA: - The PACF plot can be used to identify the value of p, the AR order. - The ACF plot can be used to identify the value of q, the MA order. - The interpretation of ACF and PACF plots to determine values of p & q for ARIMA can be complex.

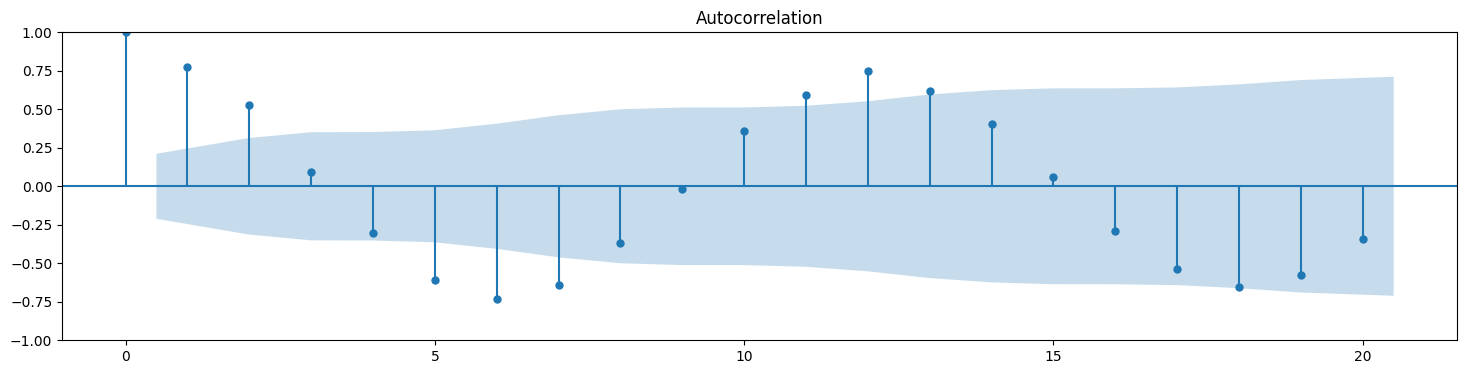

Below, we see the ACF and PACF plots for the bicycle crossings. Their seasonality is quite visible.

# Autocorrelation and partial autocorrelation plots for stock prices

plot_acf(new_df.Total);

plot_pacf(new_df.Total);

# Get raw values for auto-correlations

from statsmodels.tsa.stattools import acf

acf(new_df.Total)

array([ 1. , 0.77571582, 0.52756191, 0.09556274, -0.30509232,

-0.60545323, -0.73226582, -0.64087121, -0.37044611, -0.01811217,

0.35763185, 0.59437737, 0.7515538 , 0.61992343, 0.40344956,

0.06119329, -0.28745883, -0.53888819, -0.65309667, -0.57442506])

# Slightly nicer output making it easy to read lag and correlation

[(n,x ) for n, x in enumerate(acf(new_df.Total))]

[(0, 1.0),

(1, 0.7757158156417427),

(2, 0.5275619080263295),

(3, 0.09556274009387859),

(4, -0.30509232288765453),

(5, -0.6054532313442101),

(6, -0.732265815426328),

(7, -0.6408712113652556),

(8, -0.3704461111442763),

(9, -0.018112170681472205),

(10, 0.35763184544832965),

(11, 0.5943773727598759),

(12, 0.7515538007556243),

(13, 0.6199234263452077),

(14, 0.4034495609681654),

(15, 0.061193291548871764),

(16, -0.28745882651811744),

(17, -0.5388881889155354),

(18, -0.6530966725971313),

(19, -0.5744250570228712)]

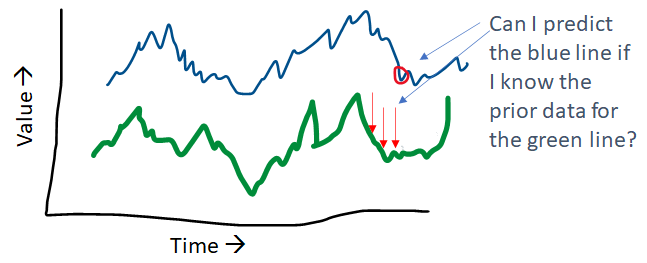

Granger Causality Tests

The Granger Causality tests are used to check if two time series are related with each other, specifically, given two time series, whether the time series in the second column can be used to predict the time series in the first column.

The ‘maxlag’ parameter needs to be specified and the code will identify the p-values at different lag points up to the maxlag value. If p-value<0.05 for any lag, that may be a valid predictor (or causal factor).

Example

This test is quite easy for us to run using statsmodels. As an example, we apply it to two separate time series, one showing the average daily temperature, and the other showing the average daily household power consumption. This data was adapted from a Kaggle dataset to create this illustration.

from statsmodels.tsa.stattools import grangercausalitytests

# Data adapted from:

# https://www.kaggle.com/srinuti/residential-power-usage-3years-data-timeseries

df_elec = pd.read_csv('pwr_usage.csv')

df_elec.index = pd.DatetimeIndex(df_elec.Date, freq='W-SUN')

df_elec.drop(['Date'], axis = 1, inplace = True)

df_elec

| Temp_avg | kwh | |

|---|---|---|

| Date | ||

| 2017-01-08 | 75.542857 | 106.549 |

| 2017-01-15 | 71.014286 | 129.096 |

| 2017-01-22 | 64.414286 | 68.770 |

| 2017-01-29 | 56.728571 | 71.378 |

| 2017-02-05 | 66.128571 | 107.829 |

| ... | ... | ... |

| 2019-12-08 | 74.371429 | 167.481 |

| 2019-12-15 | 61.242857 | 86.248 |

| 2019-12-22 | 50.000000 | 73.206 |

| 2019-12-29 | 60.128571 | 35.655 |

| 2020-01-05 | 7.185714 | 4.947 |

157 rows × 2 columns

# Check if Average Temperature can be used to predict kwh

grangercausalitytests(df_elec[["kwh", "Temp_avg"]], maxlag = 6);

Granger Causality

number of lags (no zero) 1

ssr based F test: F=0.1022 , p=0.7496 , df_denom=153, df_num=1

ssr based chi2 test: chi2=0.1042 , p=0.7468 , df=1

likelihood ratio test: chi2=0.1042 , p=0.7469 , df=1

parameter F test: F=0.1022 , p=0.7496 , df_denom=153, df_num=1

Granger Causality

number of lags (no zero) 2

ssr based F test: F=0.9543 , p=0.3874 , df_denom=150, df_num=2

ssr based chi2 test: chi2=1.9722 , p=0.3730 , df=2

likelihood ratio test: chi2=1.9597 , p=0.3754 , df=2

parameter F test: F=0.9543 , p=0.3874 , df_denom=150, df_num=2

Granger Causality

number of lags (no zero) 3

ssr based F test: F=1.6013 , p=0.1916 , df_denom=147, df_num=3

ssr based chi2 test: chi2=5.0327 , p=0.1694 , df=3

likelihood ratio test: chi2=4.9523 , p=0.1753 , df=3

parameter F test: F=1.6013 , p=0.1916 , df_denom=147, df_num=3

Granger Causality

number of lags (no zero) 4

ssr based F test: F=1.5901 , p=0.1801 , df_denom=144, df_num=4

ssr based chi2 test: chi2=6.7579 , p=0.1492 , df=4

likelihood ratio test: chi2=6.6129 , p=0.1578 , df=4

parameter F test: F=1.5901 , p=0.1801 , df_denom=144, df_num=4

Granger Causality

number of lags (no zero) 5

ssr based F test: F=1.2414 , p=0.2930 , df_denom=141, df_num=5

ssr based chi2 test: chi2=6.6913 , p=0.2446 , df=5

likelihood ratio test: chi2=6.5482 , p=0.2565 , df=5

parameter F test: F=1.2414 , p=0.2930 , df_denom=141, df_num=5

Granger Causality

number of lags (no zero) 6

ssr based F test: F=1.0930 , p=0.3697 , df_denom=138, df_num=6

ssr based chi2 test: chi2=7.1759 , p=0.3049 , df=6

likelihood ratio test: chi2=7.0106 , p=0.3199 , df=6

parameter F test: F=1.0930 , p=0.3697 , df_denom=138, df_num=6

# Check if kwh can be used to predict Average Temperature

# While we get p<0.05 at lag 3, the result is obviously absurd

grangercausalitytests(df_elec[["Temp_avg", "kwh"]], maxlag = 6);

Granger Causality

number of lags (no zero) 1

ssr based F test: F=3.1953 , p=0.0758 , df_denom=153, df_num=1

ssr based chi2 test: chi2=3.2580 , p=0.0711 , df=1

likelihood ratio test: chi2=3.2244 , p=0.0725 , df=1

parameter F test: F=3.1953 , p=0.0758 , df_denom=153, df_num=1

Granger Causality

number of lags (no zero) 2

ssr based F test: F=2.8694 , p=0.0599 , df_denom=150, df_num=2

ssr based chi2 test: chi2=5.9301 , p=0.0516 , df=2

likelihood ratio test: chi2=5.8194 , p=0.0545 , df=2

parameter F test: F=2.8694 , p=0.0599 , df_denom=150, df_num=2

Granger Causality

number of lags (no zero) 3

ssr based F test: F=3.0044 , p=0.0324 , df_denom=147, df_num=3

ssr based chi2 test: chi2=9.4423 , p=0.0240 , df=3

likelihood ratio test: chi2=9.1642 , p=0.0272 , df=3

parameter F test: F=3.0044 , p=0.0324 , df_denom=147, df_num=3

Granger Causality

number of lags (no zero) 4

ssr based F test: F=1.3019 , p=0.2722 , df_denom=144, df_num=4

ssr based chi2 test: chi2=5.5329 , p=0.2369 , df=4

likelihood ratio test: chi2=5.4352 , p=0.2455 , df=4

parameter F test: F=1.3019 , p=0.2722 , df_denom=144, df_num=4

Granger Causality

number of lags (no zero) 5

ssr based F test: F=0.8068 , p=0.5466 , df_denom=141, df_num=5

ssr based chi2 test: chi2=4.3488 , p=0.5004 , df=5

likelihood ratio test: chi2=4.2877 , p=0.5088 , df=5

parameter F test: F=0.8068 , p=0.5466 , df_denom=141, df_num=5

Granger Causality

number of lags (no zero) 6

ssr based F test: F=0.5381 , p=0.7785 , df_denom=138, df_num=6

ssr based chi2 test: chi2=3.5328 , p=0.7396 , df=6

likelihood ratio test: chi2=3.4921 , p=0.7450 , df=6

parameter F test: F=0.5381 , p=0.7785 , df_denom=138, df_num=6

In short, we don't find any causality above, though our intuition would have told us that something should exist. Perhaps there are variables other than temperature that impact power consumption that we have not thought of.

That is the power of data - commonly held conceptions can be challenged.

Forecasting with Simple Exponential Smoothing, Holt and Holt-Winters Method

(a) Simple Exponential Smoothing

In simple exponential smoothing, we reduce the time series to a single variable.

Simple exponential smoothing is suitable for forecasting data that has no clear trend or seasonal component. Obviously, this sort of data will have no pattern, so how do we forecast it? Consider two extreme approaches:

- Every future value will be equal to the average of all prior values,

- Every future value is the same as the last one.

The difference between the two extreme situations above is that in the first one, we weigh all past observations as equally important, and in the second, we give all the weight to the last observation and none to the ones prior to that.

The Simple Exponential Smoothing method takes an approach in between - it gives the most weight to the last observation, and gradually reduces the weight as we go further back in the past. It does so using a single parameter called alpha.

(Source: https://otexts.com/fpp2/ses.html)

(b) Holt's Method - Double Exponential Smoothing

Holt extended simple exponential smoothing described above to account for a trend. This is captured in a parameter called .

This method involves calculating a ‘level’, with the smoothing parameter α, as well as the trend using a smoothing parameter β. These parameters are used in a way similar to what we saw with EWMA.

Because we are using two parameters, it is called ‘double exponential smoothing’.

We can specify additive or multiplicative trends. Additive trends are preferred when the level of change over time is constant. Multiplicative trends make sense when the trend varies proportional to the current values of the series.

(c) Holt-Winters' Method - Triple Exponential Smoothing

The Holt-Winters’ seasonal method accounts for the level, as well as the trend and seasonality, with corresponding smoothing parameters α, β and γ respectively.

- Level: α

- Trend: β

- Seasonality: γ

We also specify the frequency of the seasonality, i.e., the number of periods that comprise a season. For example, for quarterly data the frequency would be 4 , and for monthly data, it would be 12.

Like for trend, we can specify whether the seasonality is additive or multiplicative.

The equations for Triple Exponential Smoothing look as follows:

We will not cover these equations in detail as the code does everything for us. As practitioners, we need to think about the problems we can solve with this, and while being aware of the underlying logic. The code will calculate the values of , and and use these in the equations above to make predictions.

# Let us look at the index of our data frame that has the bicycle crossing data

new_df.index

DatetimeIndex(['2012-10-31', '2012-11-30', '2012-12-31', '2013-01-31',

'2013-02-28', '2013-03-31', '2013-04-30', '2013-05-31',

'2013-06-30', '2013-07-31', '2013-08-31', '2013-09-30',

'2013-10-31', '2013-11-30', '2013-12-31', '2014-01-31',

'2014-02-28', '2014-03-31', '2014-04-30', '2014-05-31',

'2014-06-30', '2014-07-31', '2014-08-31', '2014-09-30',

'2014-10-31', '2014-11-30', '2014-12-31', '2015-01-31',

'2015-02-28', '2015-03-31', '2015-04-30', '2015-05-31',

'2015-06-30', '2015-07-31', '2015-08-31', '2015-09-30',

'2015-10-31', '2015-11-30', '2015-12-31', '2016-01-31',

'2016-02-29', '2016-03-31', '2016-04-30', '2016-05-31',

'2016-06-30', '2016-07-31', '2016-08-31', '2016-09-30',

'2016-10-31', '2016-11-30', '2016-12-31', '2017-01-31',

'2017-02-28', '2017-03-31', '2017-04-30', '2017-05-31',

'2017-06-30', '2017-07-31', '2017-08-31', '2017-09-30',

'2017-10-31', '2017-11-30', '2017-12-31', '2018-01-31',

'2018-02-28', '2018-03-31', '2018-04-30', '2018-05-31',

'2018-06-30', '2018-07-31', '2018-08-31', '2018-09-30',

'2018-10-31', '2018-11-30', '2018-12-31', '2019-01-31',

'2019-02-28', '2019-03-31', '2019-04-30', '2019-05-31',

'2019-06-30', '2019-07-31', '2019-08-31', '2019-09-30',

'2019-10-31', '2019-11-30'],

dtype='datetime64[ns]', name='Date', freq='M')

# Clean up the data frame, set index frequency explicitly to Monthly

# This is needed as Holt-Winters will not work otherwise

new_df.index.freq = 'M'

# Let us drop an NaN entries, just in case

new_df.dropna(inplace=True)

new_df

| Total | Moving_Avg_6m | Moving_Avg_12m | EWMA12 | |

|---|---|---|---|---|

| Date | ||||

| 2013-09-30 | 80729.0 | 97184.000000 | 74734.583333 | 82750.448591 |

| 2013-10-31 | 81352.0 | 98743.000000 | 76039.333333 | 82535.302654 |

| 2013-11-30 | 59270.0 | 90525.666667 | 76757.916667 | 78956.025322 |

| 2013-12-31 | 43553.0 | 81237.833333 | 77356.583333 | 73509.406042 |

| 2014-01-31 | 59873.0 | 71554.333333 | 78605.666667 | 71411.497420 |

| ... | ... | ... | ... | ... |

| 2019-07-31 | 137714.0 | 101472.833333 | 91343.750000 | 100389.020732 |

| 2019-08-31 | 142414.0 | 119192.000000 | 93894.166667 | 106854.402158 |

| 2019-09-30 | 112174.0 | 123644.833333 | 95221.833333 | 107672.801826 |

| 2019-10-31 | 104498.0 | 126405.833333 | 96348.166667 | 107184.370776 |

| 2019-11-30 | 84963.0 | 119045.833333 | 97725.833333 | 103765.698349 |

75 rows × 4 columns

# Set warnings to ignore so we don't get the ugly orange boxes

import warnings

warnings.filterwarnings('ignore')

# Some library imports

from statsmodels.tsa.holtwinters import SimpleExpSmoothing

from statsmodels.tsa.holtwinters import ExponentialSmoothing

from sklearn.metrics import mean_squared_error as mse

Simple Exponential Smoothing (same as EWMA)

# Train-test split

train_samples = int(new_df.shape[0] * 0.8)

train_set = new_df.iloc[:train_samples]

test_set = new_df.iloc[train_samples:]

print("Training set: ", train_set.shape[0])

print("Test set: ", test_set.shape[0])

Training set: 60

Test set: 15

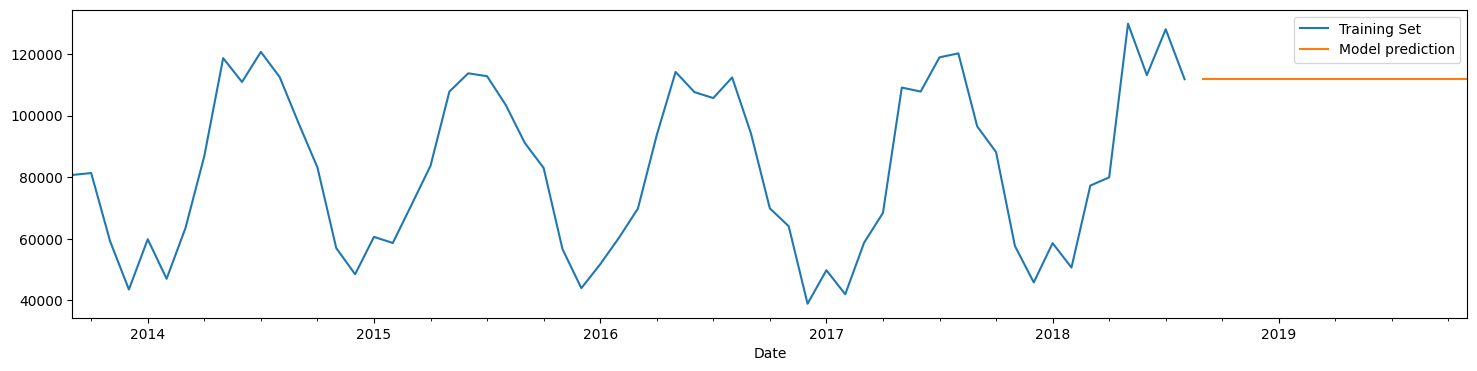

# Fit model using Simple Exponential Smoothing

model = SimpleExpSmoothing(train_set['Total']).fit()

predictions = model.forecast(15)

# let us plot the predictions and the training values

train_set['Total'].plot(legend=True,label='Training Set')

predictions.plot(legend=True,label='Model prediction');

# Now we plot test (observed) values as well

train_set['Total'].plot(legend=True,label='Training Set')

test_set['Total'].plot(legend=True,label='Test Set',figsize=(16,10))

predictions.plot(legend=True,label='Model prediction');

# Now we plot test (observed) values as well

# train_set['Total'].plot(legend=True,label='Training Set')

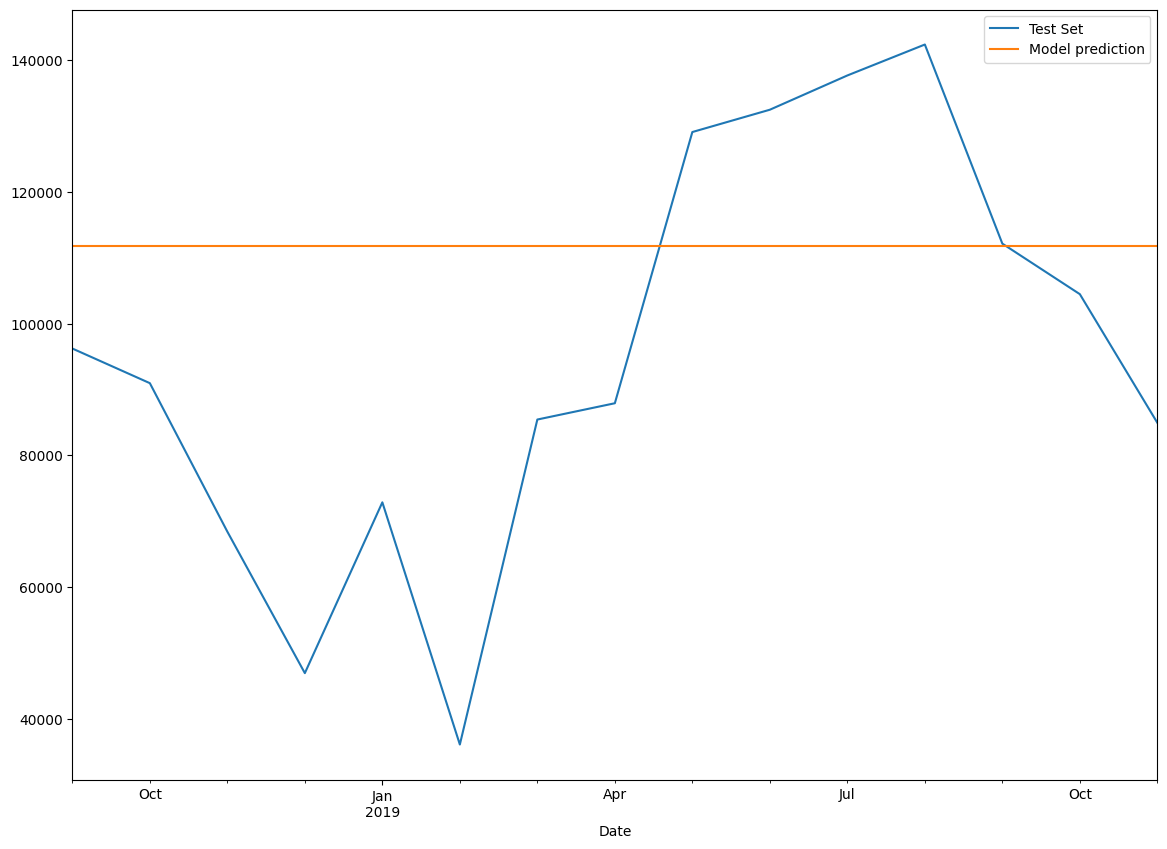

test_set['Total'].plot(legend=True,label='Test Set',figsize=(14,10))

predictions.plot(legend=True,label='Model prediction');

model.params

{'smoothing_level': 0.995,

'smoothing_trend': nan,

'smoothing_seasonal': nan,

'damping_trend': nan,

'initial_level': 80729.0,

'initial_trend': nan,

'initial_seasons': array([], dtype=float64),

'use_boxcox': False,

'lamda': None,

'remove_bias': False}

# Calculate Evaluation Metrics

y_test = test_set['Total']

y_pred = predictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2018-09-30 | 96242.0 | 111889.675227 | -15647.675227 |

| 2018-10-31 | 90982.0 | 111889.675227 | -20907.675227 |

| 2018-11-30 | 68431.0 | 111889.675227 | -43458.675227 |

| 2018-12-31 | 46941.0 | 111889.675227 | -64948.675227 |

| 2019-01-31 | 72883.0 | 111889.675227 | -39006.675227 |

| 2019-02-28 | 36099.0 | 111889.675227 | -75790.675227 |

| 2019-03-31 | 85457.0 | 111889.675227 | -26432.675227 |

| 2019-04-30 | 87932.0 | 111889.675227 | -23957.675227 |

| 2019-05-31 | 129123.0 | 111889.675227 | 17233.324773 |

| 2019-06-30 | 132512.0 | 111889.675227 | 20622.324773 |

| 2019-07-31 | 137714.0 | 111889.675227 | 25824.324773 |

| 2019-08-31 | 142414.0 | 111889.675227 | 30524.324773 |

| 2019-09-30 | 112174.0 | 111889.675227 | 284.324773 |

| 2019-10-31 | 104498.0 | 111889.675227 | -7391.675227 |

| 2019-11-30 | 84963.0 | 111889.675227 | -26926.675227 |

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 1228535508.79919

RMSE = 35050.47087842316

MAE = 29263.82507577501

Double Exponential Smoothing

# Train-test split

train_samples = int(new_df.shape[0] * 0.8)

train_set = new_df.iloc[:train_samples]

test_set = new_df.iloc[train_samples:]

print("Training set: ", train_set.shape[0])

print("Test set: ", test_set.shape[0])

Training set: 60

Test set: 15

# Fit model using Simple Exponential Smoothing

# model = SimpleExpSmoothing(train_set['Total']).fit()

# Double Exponential Smoothing

model = ExponentialSmoothing(train_set['Total'], trend='mul').fit()

predictions = model.forecast(15)

# let us plot the predictions and the training values

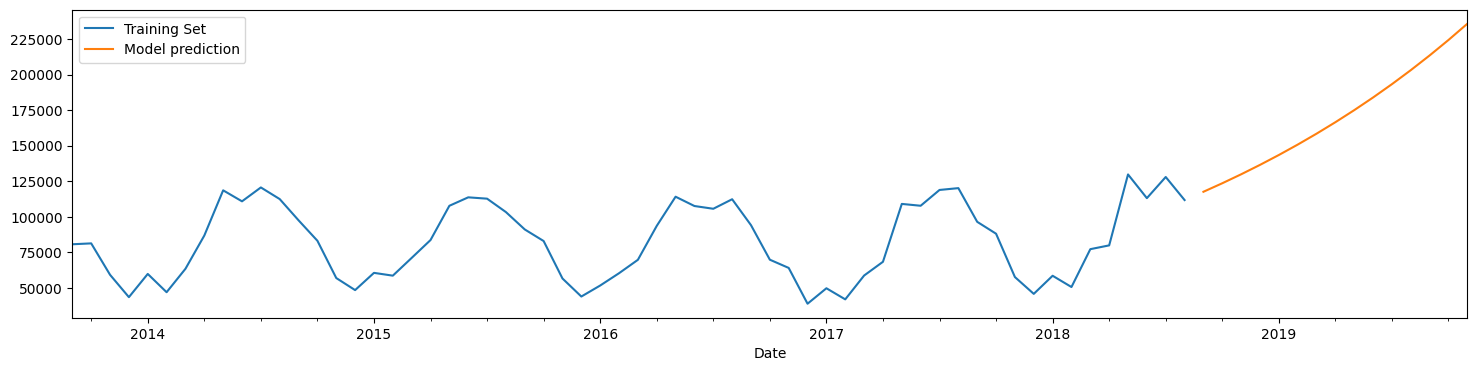

train_set['Total'].plot(legend=True,label='Training Set')

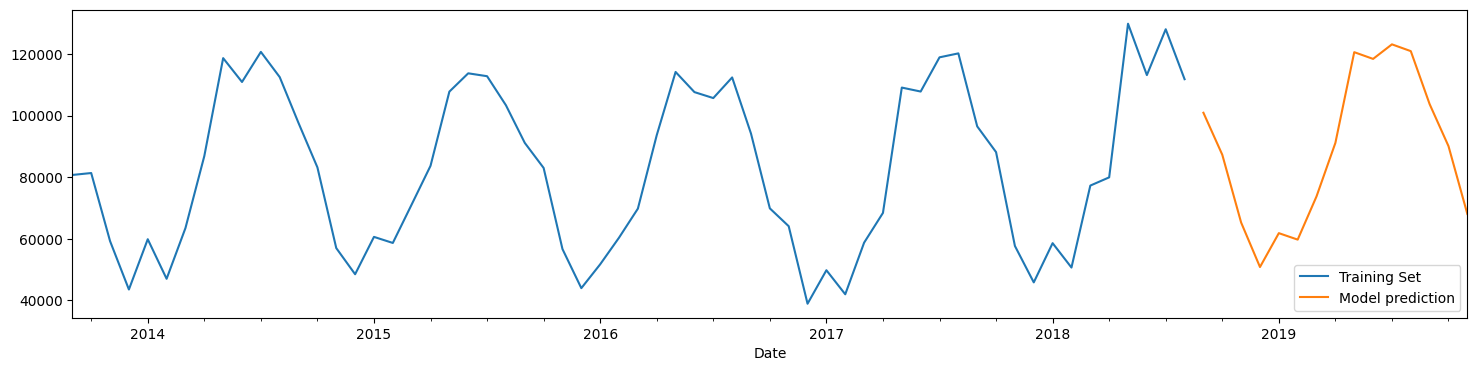

predictions.plot(legend=True,label='Model prediction');

# Now we plot test (observed) values as well

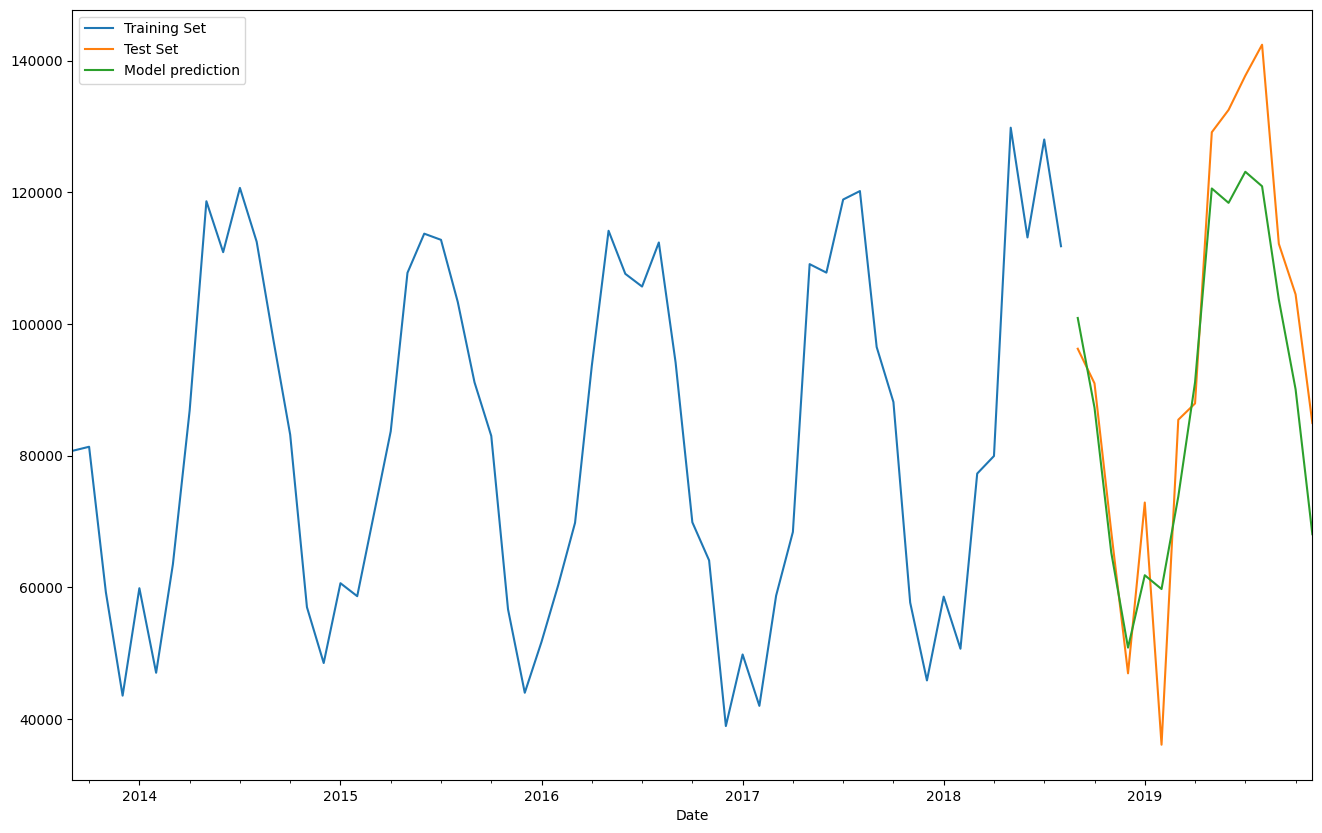

train_set['Total'].plot(legend=True,label='Training Set')

test_set['Total'].plot(legend=True,label='Test Set',figsize=(16,10))

predictions.plot(legend=True,label='Model prediction');

# Now we plot test (observed) values as well

# train_set['Total'].plot(legend=True,label='Training Set')

test_set['Total'].plot(legend=True,label='Test Set',figsize=(14,10))

predictions.plot(legend=True,label='Model prediction');

model.params

{'smoothing_level': 0.995,

'smoothing_trend': 0.04738095238095238,

'smoothing_seasonal': nan,

'damping_trend': nan,

'initial_level': 51251.999999999985,

'initial_trend': 1.084850613368525,

'initial_seasons': array([], dtype=float64),

'use_boxcox': False,

'lamda': None,

'remove_bias': False}

# Calculate Evaluation Metrics

y_test = test_set['Total']

y_pred = predictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2018-09-30 | 96242.0 | 117626.951449 | -21384.951449 |

| 2018-10-31 | 90982.0 | 123616.042220 | -32634.042220 |

| 2018-11-30 | 68431.0 | 129910.073380 | -61479.073380 |

| 2018-12-31 | 46941.0 | 136524.571266 | -89583.571266 |

| 2019-01-31 | 72883.0 | 143475.852752 | -70592.852752 |

| 2019-02-28 | 36099.0 | 150781.065503 | -114682.065503 |

| 2019-03-31 | 85457.0 | 158458.230275 | -73001.230275 |

| 2019-04-30 | 87932.0 | 166526.285367 | -78594.285367 |

| 2019-05-31 | 129123.0 | 175005.133341 | -45882.133341 |

| 2019-06-30 | 132512.0 | 183915.690115 | -51403.690115 |

| 2019-07-31 | 137714.0 | 193279.936564 | -55565.936564 |

| 2019-08-31 | 142414.0 | 203120.972739 | -60706.972739 |

| 2019-09-30 | 112174.0 | 213463.074854 | -101289.074854 |

| 2019-10-31 | 104498.0 | 224331.755168 | -119833.755168 |

| 2019-11-30 | 84963.0 | 235753.824924 | -150790.824924 |

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 6789777046.197141

RMSE = 82400.10343559734

MAE = 75161.63066121914

Triple Exponential Smoothing

# Train-test split

train_samples = int(new_df.shape[0] * 0.8)

train_set = new_df.iloc[:train_samples]

test_set = new_df.iloc[train_samples:]

print("Training set: ", train_set.shape[0])

print("Test set: ", test_set.shape[0])

Training set: 60

Test set: 15

# Let us use the triple exponential smoothing model

model = ExponentialSmoothing(train_set['Total'],trend='add', \

seasonal='add',seasonal_periods=12).fit()

predictions = model.forecast(15)

# let us plot the predictions and the training values

train_set['Total'].plot(legend=True,label='Training Set')

predictions.plot(legend=True,label='Model prediction');

# Now we plot test (observed) values as well

train_set['Total'].plot(legend=True,label='Training Set')

test_set['Total'].plot(legend=True,label='Test Set',figsize=(16,10))

predictions.plot(legend=True,label='Model prediction');

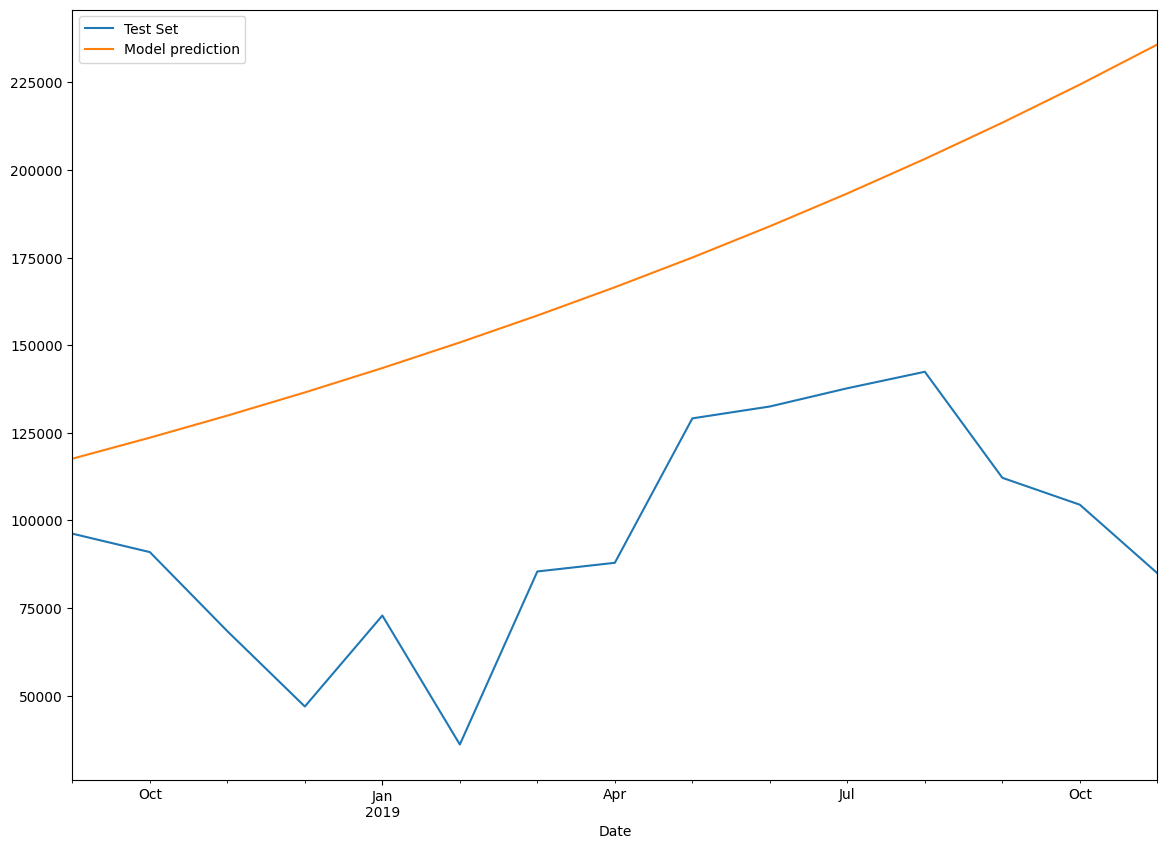

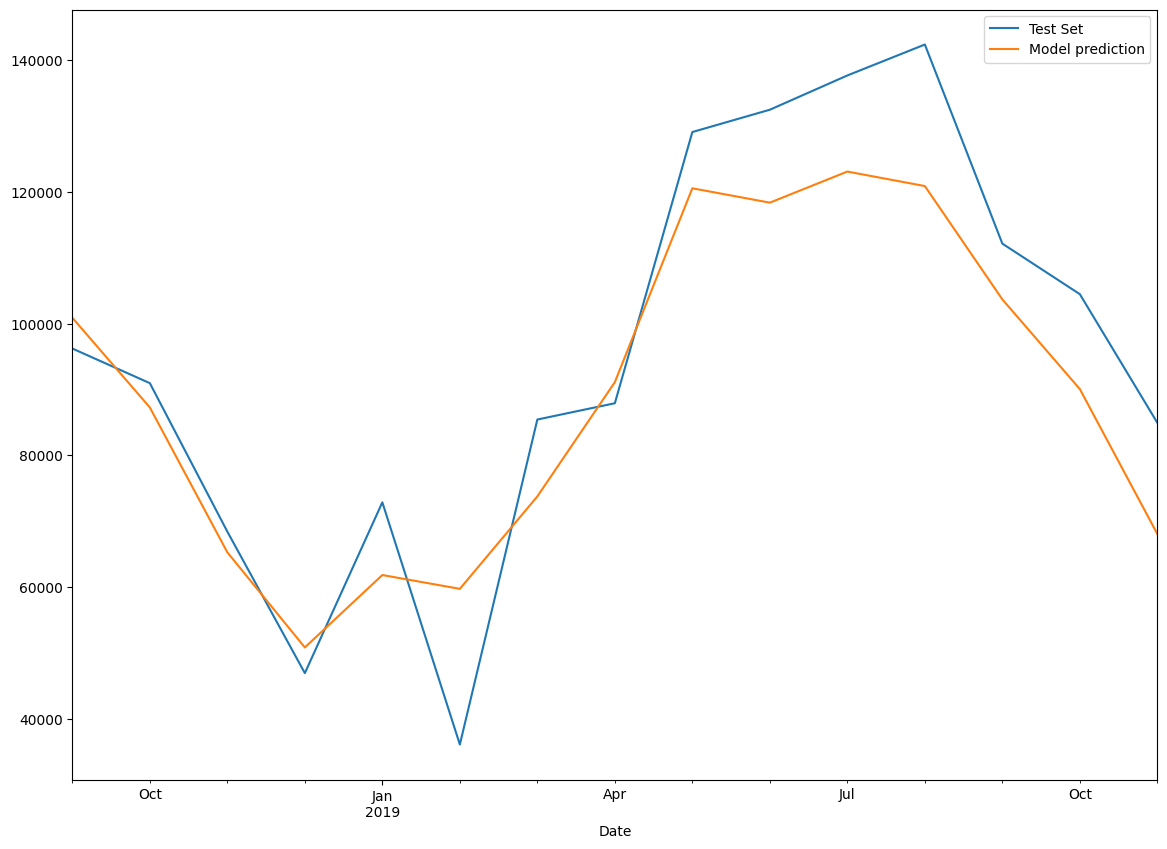

# Test vs observed - closeup of the predictions

# train_set['Total'].plot(legend=True,label='Training Set')

test_set['Total'].plot(legend=True,label='Test Set',figsize=(14,10))

predictions.plot(legend=True,label='Model prediction');

model.params

{'smoothing_level': 0.2525,

'smoothing_trend': 0.0001,

'smoothing_seasonal': 0.0001,

'damping_trend': nan,

'initial_level': 82880.52777777775,

'initial_trend': 233.32297979798386,

'initial_seasons': array([ 12706.58333333, -1150.10416667, -23387.98958333, -38062.89583333,

-27297.51041667, -29627.21875 , -15820.59375 , 1298.15625 ,

30509.6875 , 28095.90625 , 32583.70833333, 30152.27083333]),

'use_boxcox': False,

'lamda': None,

'remove_bias': False}

# Calculate Evaluation Metrics

y_test = test_set['Total']

y_pred = predictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2018-09-30 | 96242.0 | 100914.043265 | -4672.043265 |

| 2018-10-31 | 90982.0 | 87291.600234 | 3690.399766 |

| 2018-11-30 | 68431.0 | 65286.060329 | 3144.939671 |

| 2018-12-31 | 46941.0 | 50843.440823 | -3902.440823 |

| 2019-01-31 | 72883.0 | 61841.794519 | 11041.205481 |

| 2019-02-28 | 36099.0 | 59743.301291 | -23644.301291 |

| 2019-03-31 | 85457.0 | 73783.743291 | 11673.256709 |

| 2019-04-30 | 87932.0 | 91133.340351 | -3201.340351 |

| 2019-05-31 | 129123.0 | 120579.559129 | 8543.440871 |

| 2019-06-30 | 132512.0 | 118396.387406 | 14115.612594 |

| 2019-07-31 | 137714.0 | 123117.725595 | 14596.274405 |

| 2019-08-31 | 142414.0 | 120917.981585 | 21496.018415 |

| 2019-09-30 | 112174.0 | 103703.284649 | 8470.715351 |

| 2019-10-31 | 104498.0 | 90080.841618 | 14417.158382 |

| 2019-11-30 | 84963.0 | 68075.301713 | 16887.698287 |

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 160014279.71049073

RMSE = 12649.675083198412

MAE = 10899.78971069559

model = ExponentialSmoothing(new_df['Total'], trend='mul').fit()

# Fit values

pd.DataFrame({'fitted':model.fittedvalues.shift(-1), 'actual':new_df['Total']})

| fitted | actual | |

|---|---|---|

| Date | ||

| 2013-09-30 | 88374.142596 | 80729.0 |

| 2013-10-31 | 89066.318586 | 81352.0 |

| 2013-11-30 | 64512.628727 | 59270.0 |

| 2013-12-31 | 47037.321040 | 43553.0 |

| 2014-01-31 | 64853.079989 | 59873.0 |

| ... | ... | ... |

| 2019-07-31 | 147204.031288 | 137714.0 |

| 2019-08-31 | 152114.454701 | 142414.0 |

| 2019-09-30 | 119265.035267 | 112174.0 |

| 2019-10-31 | 110660.795745 | 104498.0 |

| 2019-11-30 | NaN | 84963.0 |

75 rows × 2 columns

# Examine model parameters

model.params

{'smoothing_level': 0.995,

'smoothing_trend': 0.02369047619047619,

'smoothing_seasonal': nan,

'damping_trend': nan,

'initial_level': 51251.999999999985,

'initial_trend': 1.084850613368525,

'initial_seasons': array([], dtype=float64),

'use_boxcox': False,

'lamda': None,

'remove_bias': False}

# RMSE calculation

x = pd.DataFrame({'fitted':model.fittedvalues.shift(-1), 'actual':new_df['Total']}).dropna()

rmse = np.sqrt(mse(x.fitted, x.actual))

rmse

6017.795365317929

# predict the next 15 values

predictions = model.forecast(15)

predictions

2019-12-31 89553.250900

2020-01-31 94248.964768

2020-02-29 99190.897823

2020-03-31 104391.960540

2020-04-30 109865.740351

2020-05-31 115626.537143

2020-06-30 121689.400618

2020-07-31 128070.169604

2020-08-31 134785.513440

2020-09-30 141852.975517

2020-10-31 149291.019112

2020-11-30 157119.075623

2020-12-31 165357.595328

2021-01-31 174028.100817

2021-02-28 183153.243211

Freq: M, dtype: float64

model.fittedvalues

Date

2013-09-30 55600.763636

2013-10-31 88374.142596

2013-11-30 89066.318586

2013-12-31 64512.628727

2014-01-31 47037.321040

...

2019-07-31 141747.388757

2019-08-31 147204.031288

2019-09-30 152114.454701

2019-10-31 119265.035267

2019-11-30 110660.795745

Freq: M, Length: 75, dtype: float64

ARIMA - Auto Regressive Integrated Moving Average

ARIMA stands for Auto Regressive Integrated Moving Average. It is a general method for understanding and predicting time series data.

ARIMA models come in several different flavors, for example:

- Non-seasonal ARIMA

- Seasonal ARIMA (Called SARIMA)

- SARIMA with external variables, called SARIMAX

Which one should we use? ARIMA or Holt-Winters?

Try both. Whatever works better for your use case is the one to use.

ARIMA models have three non-negative integer parameters – p, d and q.

- p represents the Auto-Regression component, AR. This is the part of the model that leverages the linear regression between an observation and past observations.

- d represents differencing, the I component. This is the number of times the series has to be differenced to make it stationary.

- q represents the MA component, the number of lagged forecast errors in the prediction. This considers the relationship between an observation and the residual error from a moving average model.

A correct choice of the ‘order’ of your ARIMA model, ie deciding the values of p, d and q, is essential to building a good ARIMA model.

Deciding the values of p, d and q

- Values of p and q can be determined manually by examining auto-correlation and partial-autocorrelation plots.

- The value of d can be determined by repeatedly differencing a series till we get to a stationary series.

The manual methods are time consuming, and less precise. An overview of these is provided in the Appendix to this slide deck.

In reality, we let the computer do a grid search (a brute force test of a set of permutations for p, d and q) to determine the order of our ARIMA model. The Pyramid ARIMA library in Python allows searching through multiple combinations of p, d and q to identify the best model.

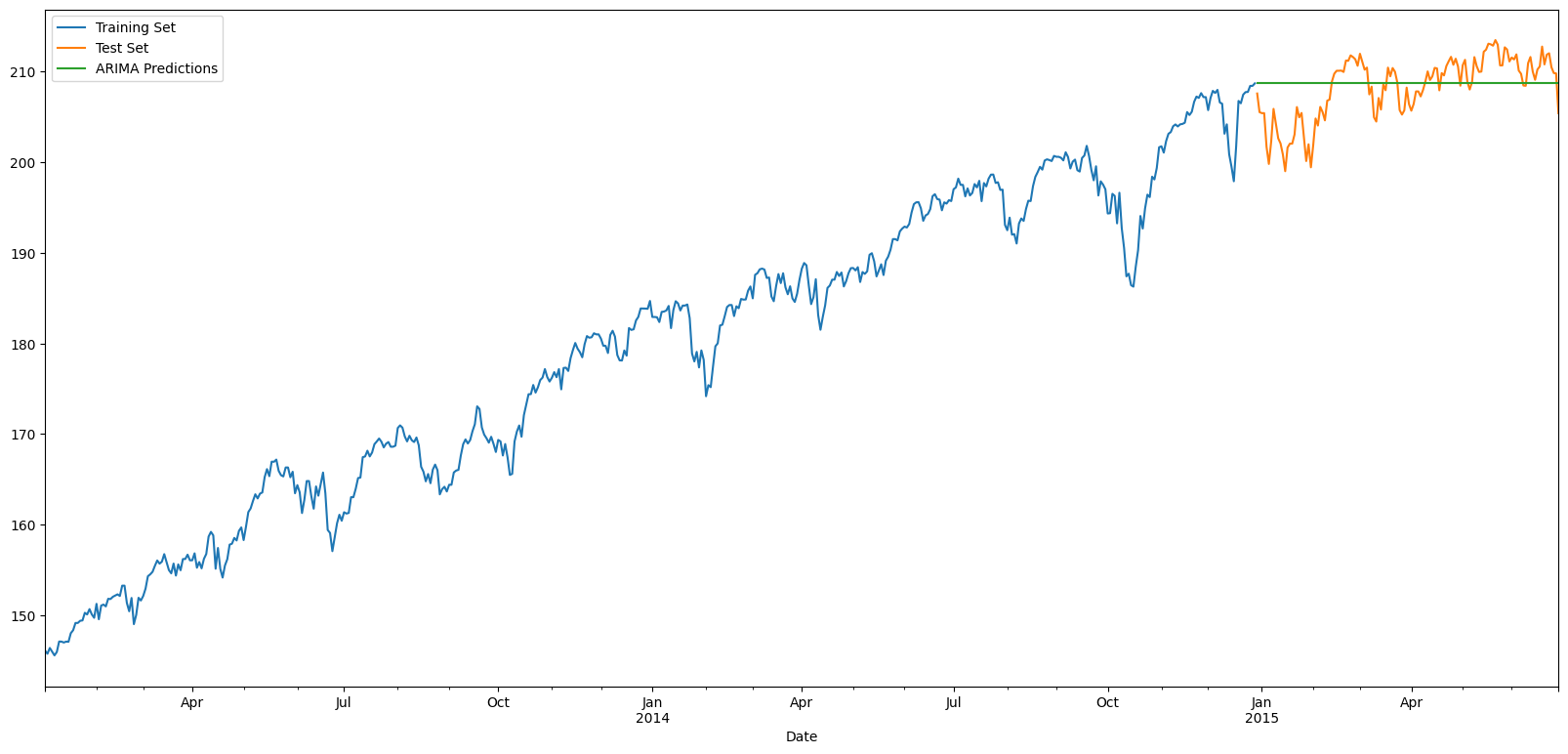

ARIMA in Action

1. Split dataset into train and test.

2. Test set should be the last n entries. Can’t use random selection for train-test split.

3. Pyramid ARIMA is a Python package that can identify the values of p, d and q to use. Use Auto ARIMA from Pyramid ARIMA to find good values of p, d and q based on the training data set.

4. Fit a model on the training data set.

5. Predict the test set, and evaluate using MSE, MAE or RMSE.

# Library imports

from pmdarima import auto_arima

# Train-test split

train_samples = int(new_df.shape[0] * 0.8)

train_set = new_df.iloc[:train_samples]

test_set = new_df.iloc[train_samples:]

print("Training set: ", train_set.shape[0])

print("Test set: ", test_set.shape[0])

Training set: 60

Test set: 15

# Clean up

train_set.dropna(inplace=True)

Use Auto ARIMA to find out order

# Build a model using auto_arima

model = auto_arima(train_set['Total'],seasonal=False)

order = model.get_params()['order']

seasonal_order = model.get_params()['seasonal_order']

print('Order = ', order)

print('Seasonal Order = ', seasonal_order)

Order = (5, 0, 1)

Seasonal Order = (0, 0, 0, 0)

# Create and fit model

from statsmodels.tsa.arima.model import ARIMA

model_ARIMA = ARIMA(train_set['Total'], order = order)

model_ARIMA = model_ARIMA.fit()

# Predict with ARIMA

start=len(train_set)

end=len(train_set)+len(test_set)-1

ARIMApredictions = model_ARIMA.predict(start=start, end=end, dynamic=False, typ='levels').rename('ARIMA Predictions')

# model_ARIMA.summary()

# Calculate Evaluation Metrics

y_test = test_set['Total']

y_pred = ARIMApredictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2018-09-30 | 96242.0 | 97178.782841 | -936.782841 |

| 2018-10-31 | 90982.0 | 68163.166776 | 22818.833224 |

| 2018-11-30 | 68431.0 | 56095.942557 | 12335.057443 |

| 2018-12-31 | 46941.0 | 41005.329654 | 5935.670346 |

| 2019-01-31 | 72883.0 | 42591.251732 | 30291.748268 |

| 2019-02-28 | 36099.0 | 51555.855575 | -15456.855575 |

| 2019-03-31 | 85457.0 | 71734.836673 | 13722.163327 |

| 2019-04-30 | 87932.0 | 91198.670052 | -3266.670052 |

| 2019-05-31 | 129123.0 | 110818.433668 | 18304.566332 |

| 2019-06-30 | 132512.0 | 121161.132303 | 11350.867697 |

| 2019-07-31 | 137714.0 | 122198.078813 | 15515.921187 |

| 2019-08-31 | 142414.0 | 111847.671126 | 30566.328874 |

| 2019-09-30 | 112174.0 | 94763.626480 | 17410.373520 |

| 2019-10-31 | 104498.0 | 73934.456312 | 30563.543688 |

| 2019-11-30 | 84963.0 | 56060.536900 | 28902.463100 |

# Calculate evaluation metrics

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 385065542.1818603

RMSE = 19623.086968717747

MAE = 17158.523031611756

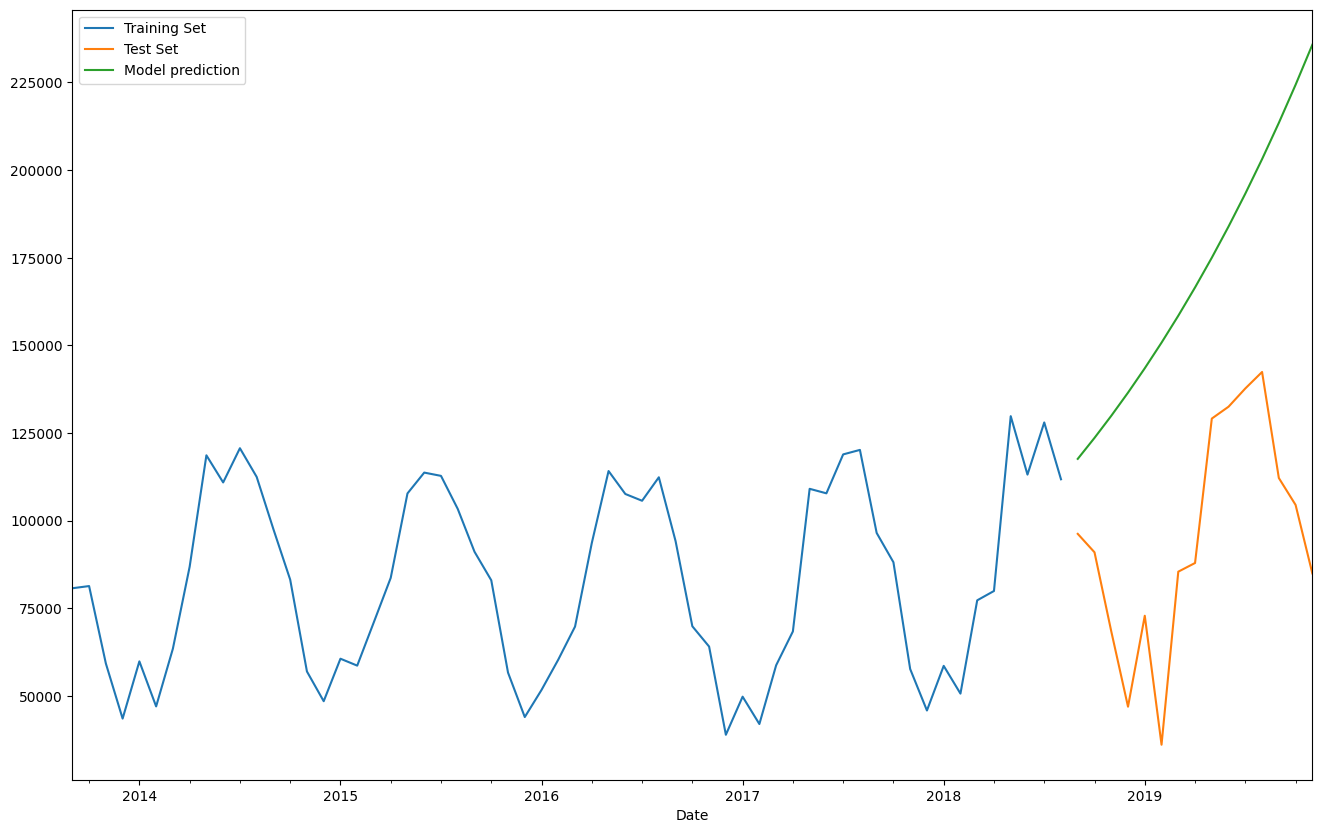

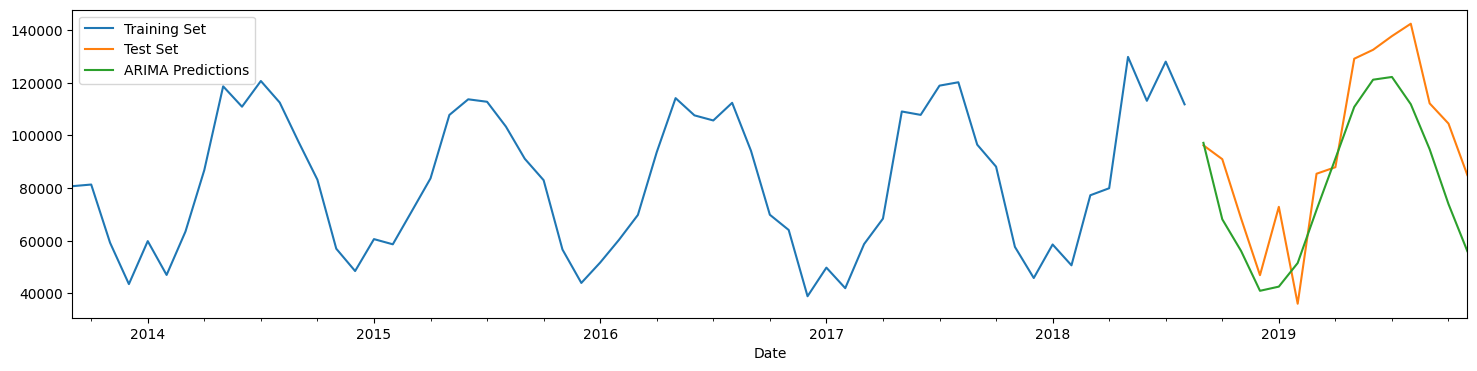

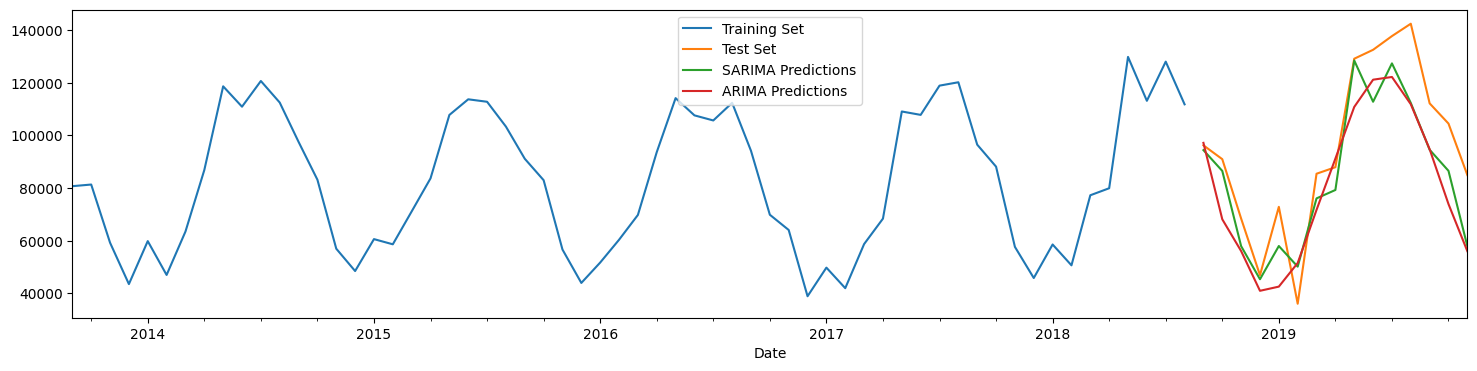

# Plot results

train_set['Total'].rename('Training Set').plot(legend=True)

test_set['Total'].rename('Test Set').plot(legend=True)

ARIMApredictions.plot(legend=True)

plt.show()

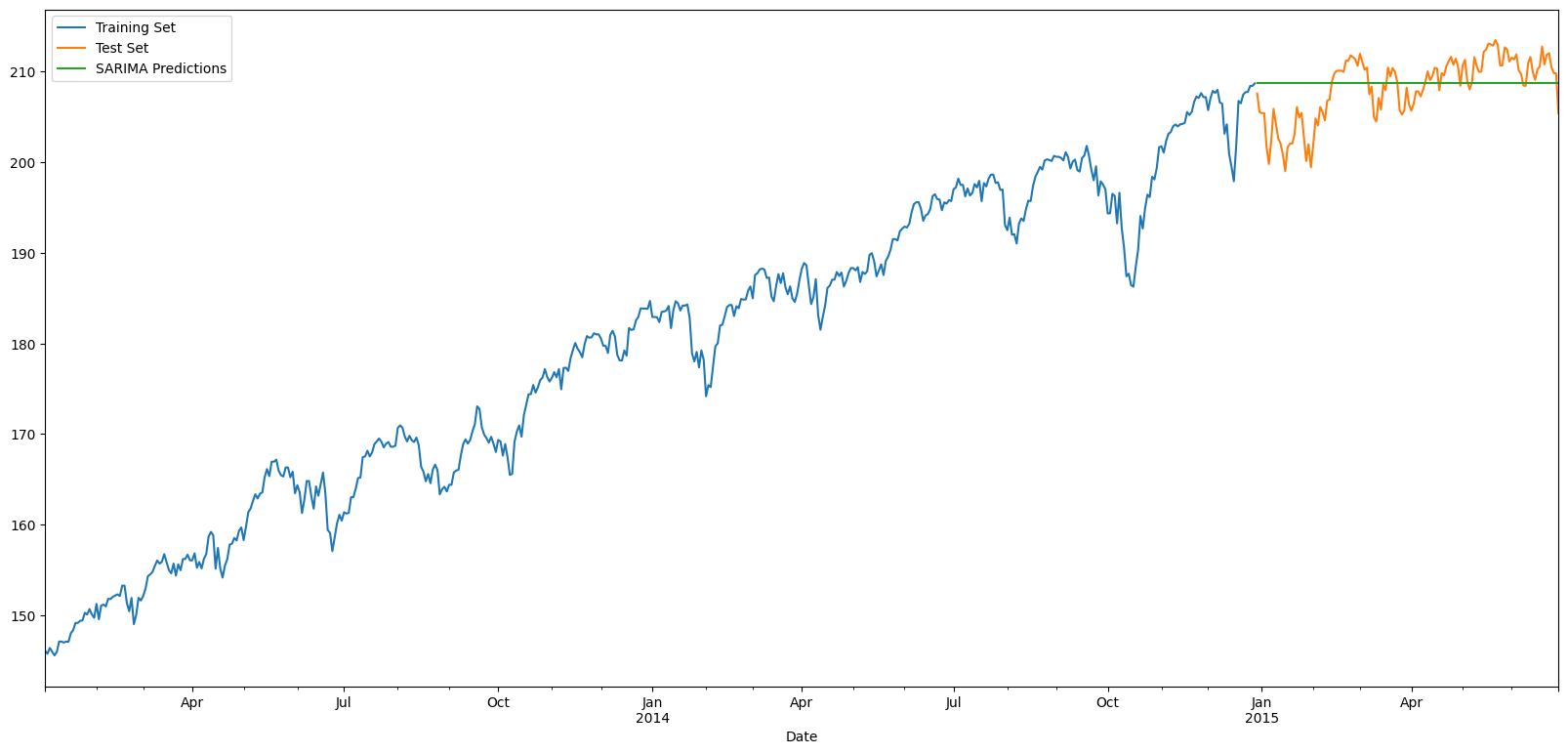

Seasonal ARIMA - SARIMA

SARIMA, or Seasonal ARIMA, accounts for seasonality. In order to account for seasonality, we need three more parameters – P, D and Q – to take care of seasonal variations.

Auto ARIMA takes care of seasonality as well, and provides us the values for P, D and Q just like it does for p, d and q.

To use SARIMA, we now need 7 parameters for our function:

- p

- d

- q

- P

- D

- Q

- m (frequency of our seasons, eg, 12)

SARIMA in Action

1. Split dataset into train and test.

2. Test set should be the last n entries. Can’t use random selection for train-test split.

3. Pyramid ARIMA is a Python package that can identify the values of p, d, q, P, D and Q to use. Use Auto ARIMA from Pyramid ARIMA to find good values of p, d and q based on the training data set.

4. Fit a model on the training data set.

5. Predict the test set, and evaluate using MSE, MAE or RMSE.

# Create a model with auto_arima

model = auto_arima(train_set['Total'],seasonal=True,m=12)

# Get values of p, d, q, P, D and Q

order = model.get_params()['order']

seasonal_order = model.get_params()['seasonal_order']

print('Order = ', order)

print('Seasonal Order = ', seasonal_order)

Order = (1, 0, 0)

Seasonal Order = (0, 1, 1, 12)

# Create and fit model

from statsmodels.tsa.statespace.sarimax import SARIMAX

model_SARIMA = SARIMAX(train_set['Total'], order=order, seasonal_order=seasonal_order)

model_SARIMA = model_SARIMA.fit()

model_SARIMA.params

ar.L1 2.438118e-01

ma.S.L12 -6.668071e-02

sigma2 7.885998e+07

dtype: float64

# Create SARIMA predictions

start=len(train_set)

end=len(train_set)+len(test_set)-1

SARIMApredictions = model_SARIMA.predict(start=start, end=end, dynamic=False, typ='levels').rename('SARIMA Predictions')

# Calculate Evaluation Metrics

y_test = test_set['Total']

y_pred = SARIMApredictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2018-09-30 | 96242.0 | 94423.659176 | 1818.340824 |

| 2018-10-31 | 90982.0 | 86518.880961 | 4463.119039 |

| 2018-11-30 | 68431.0 | 57965.336973 | 10465.663027 |

| 2018-12-31 | 46941.0 | 45396.267772 | 1544.732228 |

| 2019-01-31 | 72883.0 | 58009.524643 | 14873.475357 |

| 2019-02-28 | 36099.0 | 50177.757219 | -14078.757219 |

| 2019-03-31 | 85457.0 | 76096.865509 | 9360.134491 |

| 2019-04-30 | 87932.0 | 79286.971453 | 8645.028547 |

| 2019-05-31 | 129123.0 | 128451.795674 | 671.204326 |

| 2019-06-30 | 132512.0 | 112789.442695 | 19722.557305 |

| 2019-07-31 | 137714.0 | 127353.588372 | 10360.411628 |

| 2019-08-31 | 142414.0 | 112330.356235 | 30083.643765 |

| 2019-09-30 | 112174.0 | 94550.771990 | 17623.228010 |

| 2019-10-31 | 104498.0 | 86549.872568 | 17948.127432 |

| 2019-11-30 | 84963.0 | 57972.893093 | 26990.106907 |

# Metrics

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 231993016.88445473

RMSE = 15231.316978004716

MAE = 12576.56867360885

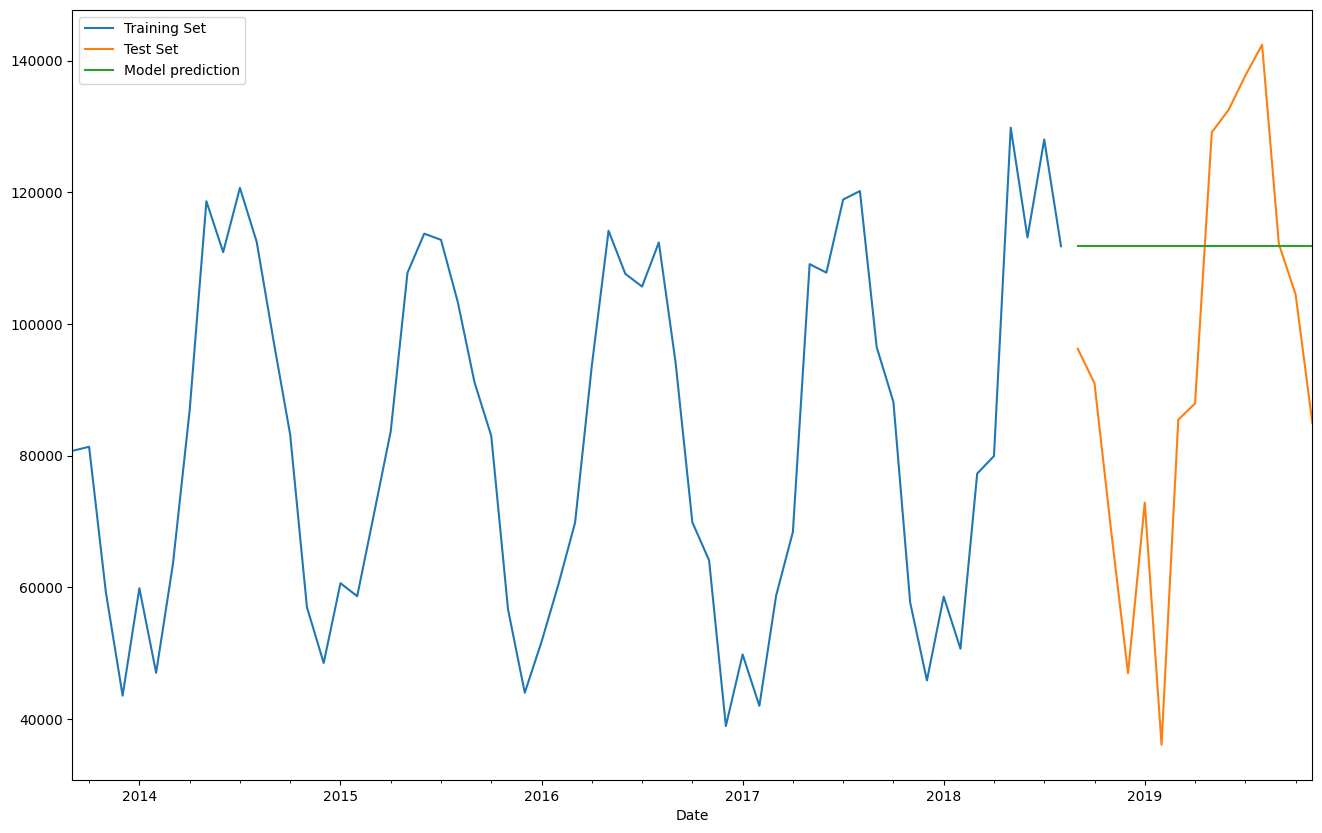

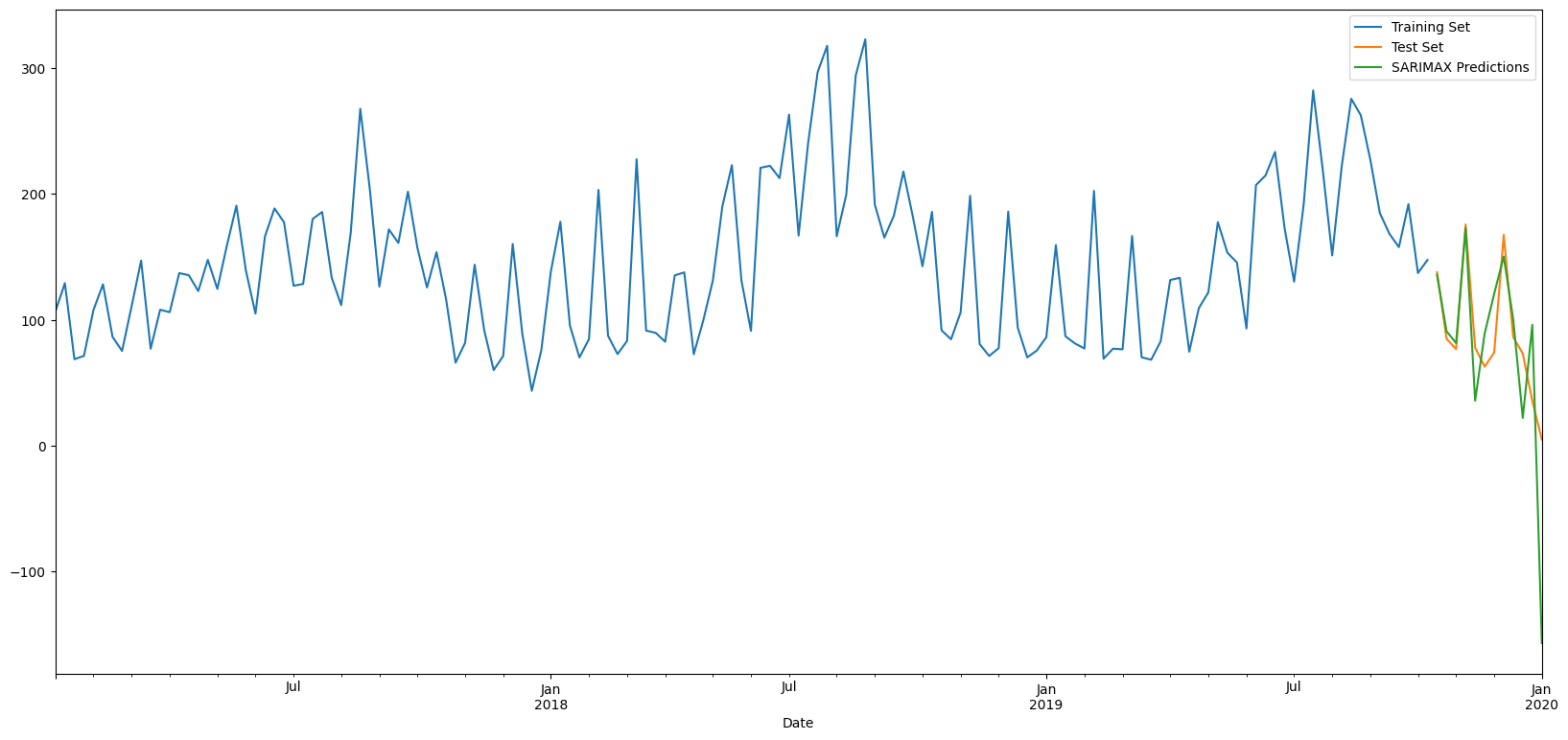

# Plot results

train_set['Total'].rename('Training Set').plot(legend=True)

test_set['Total'].rename('Test Set').plot(legend=True)

SARIMApredictions.plot(legend = True)

ARIMApredictions.plot(legend=True)

plt.show()

# Models compared to each other - calculate MAE, RMSE

from sklearn.metrics import mean_squared_error as mse

from sklearn.metrics import mean_absolute_error as mae

print('SARIMA:')

print(' RMSE = ' ,mse(SARIMApredictions, test_set['Total'], squared = False))

print(' MAE = ', mae(SARIMApredictions, test_set['Total']))

print('\nARIMA:')

print(' RMSE = ' ,mse(ARIMApredictions, test_set['Total'], squared = False))

print(' MAE = ', mae(ARIMApredictions, test_set['Total']))

print('\n')

print(' Mean of the data = ', new_df.Total.mean())

print(' St Dev of the data = ', new_df.Total.std())

SARIMA:

RMSE = 15231.316978004716

MAE = 12576.56867360885

ARIMA:

RMSE = 19623.086968717747

MAE = 17158.523031611756

Mean of the data = 85078.8

St Dev of the data = 28012.270090473237

SARIMAX

SARIMAX = Seasonal ARIMA with eXogenous variable

SARIMAX is the same as SARIMA, but there is an additional predictor variable in addition to just the time series itself.

Let us load some data showing weekly power consumption as well as average daily temperature. We will try to predict kwh as a time series, and also use Temp_avg as an exogenous variable.

In order to predict the future, you need the past data series, plus observed values for the exogenous variable. That can sometimes be difficult because the future may not yet have revealed itself yet, and while you may be able to build a model that evaluates well, you will not be able to use it.

# Data adapted from:

# https://www.kaggle.com/srinuti/residential-power-usage-3years-data-timeseries

# The data shows weekly electricity usage and the average temperature of the week.

# Our hypothesis is that the power consumed can be predicted using the average

# temperature, and the pattern found in the time series.

df_elec = pd.read_csv('pwr_usage.csv')

df_elec

| Date | Temp_avg | kwh | |

|---|---|---|---|

| 0 | 1/8/2017 | 75.542857 | 106.549 |

| 1 | 1/15/2017 | 71.014286 | 129.096 |

| 2 | 1/22/2017 | 64.414286 | 68.770 |

| 3 | 1/29/2017 | 56.728571 | 71.378 |

| 4 | 2/5/2017 | 66.128571 | 107.829 |

| ... | ... | ... | ... |

| 152 | 12/8/2019 | 74.371429 | 167.481 |

| 153 | 12/15/2019 | 61.242857 | 86.248 |

| 154 | 12/22/2019 | 50.000000 | 73.206 |

| 155 | 12/29/2019 | 60.128571 | 35.655 |

| 156 | 1/5/2020 | 7.185714 | 4.947 |

157 rows × 3 columns

Data exploration

df_elec.index = pd.DatetimeIndex(df_elec.Date, freq='W-SUN')

df_elec.drop(['Date'], axis = 1, inplace = True)

df_elec

| Temp_avg | kwh | |

|---|---|---|

| Date | ||

| 2017-01-08 | 75.542857 | 106.549 |

| 2017-01-15 | 71.014286 | 129.096 |

| 2017-01-22 | 64.414286 | 68.770 |

| 2017-01-29 | 56.728571 | 71.378 |

| 2017-02-05 | 66.128571 | 107.829 |

| ... | ... | ... |

| 2019-12-08 | 74.371429 | 167.481 |

| 2019-12-15 | 61.242857 | 86.248 |

| 2019-12-22 | 50.000000 | 73.206 |

| 2019-12-29 | 60.128571 | 35.655 |

| 2020-01-05 | 7.185714 | 4.947 |

157 rows × 2 columns

df_elec.index

DatetimeIndex(['2017-01-08', '2017-01-15', '2017-01-22', '2017-01-29',

'2017-02-05', '2017-02-12', '2017-02-19', '2017-02-26',

'2017-03-05', '2017-03-12',

...

'2019-11-03', '2019-11-10', '2019-11-17', '2019-11-24',

'2019-12-01', '2019-12-08', '2019-12-15', '2019-12-22',

'2019-12-29', '2020-01-05'],

dtype='datetime64[ns]', name='Date', length=157, freq='W-SUN')

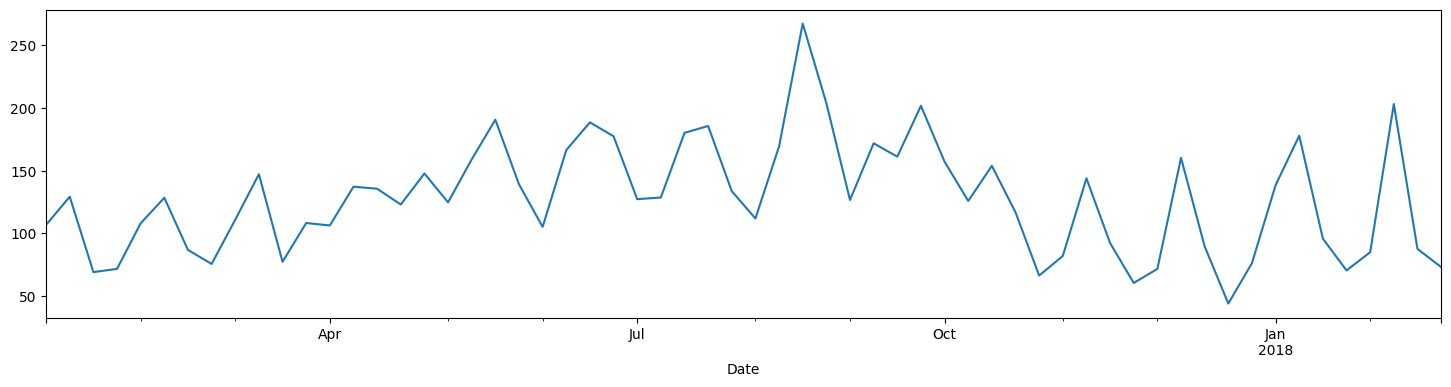

df_elec['kwh'][:60].plot()

<Axes: xlabel='Date'>

plt.rc("figure", figsize=(18,4))

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf

plot_acf(df_elec['kwh']);

plot_pacf(df_elec['kwh']);

result = seasonal_decompose(df_elec['kwh'], model = 'additive')

plt.rcParams['figure.figsize'] = (20, 9)

result.plot();

# Plot the months to see trends over months

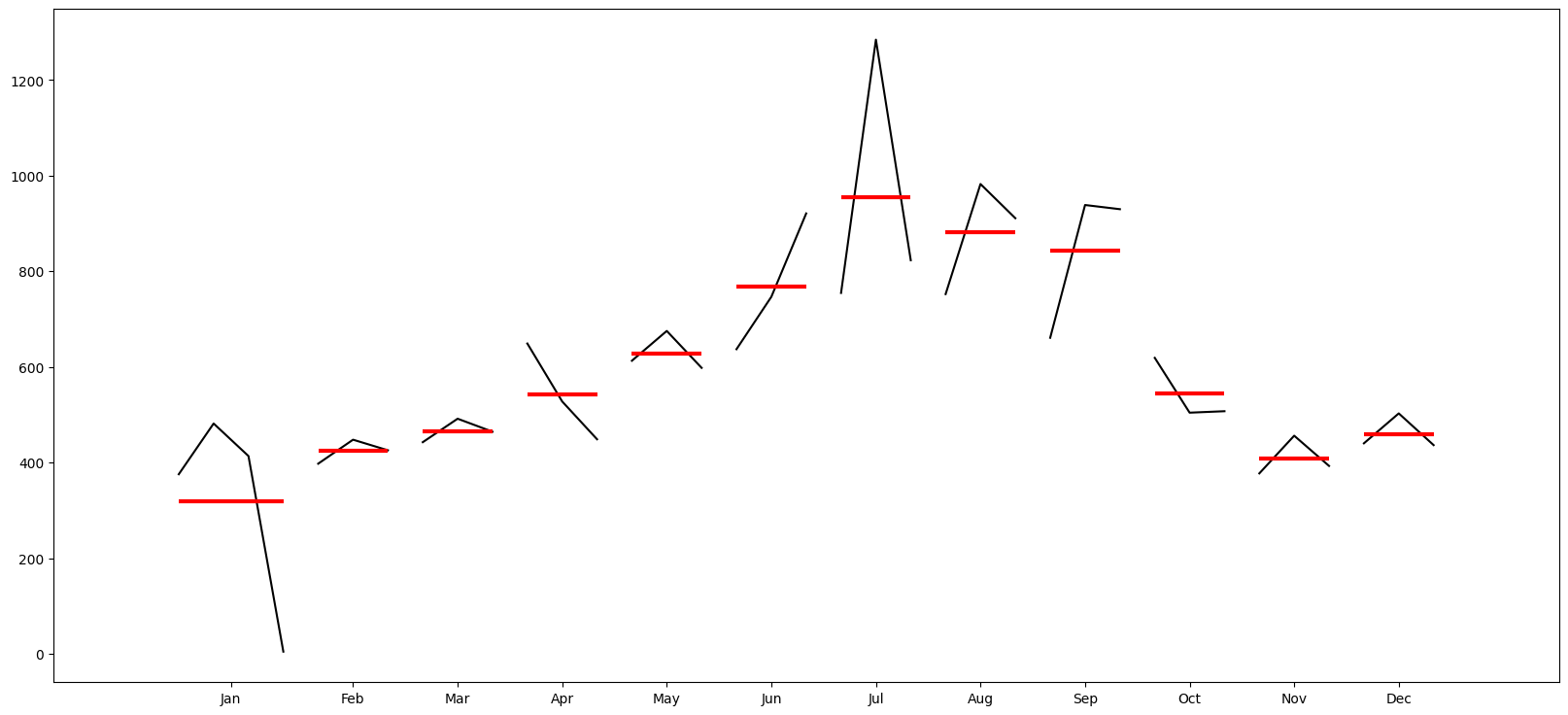

month_plot(df_elec[['kwh']].resample(rule='M').kwh.sum());

# Plot the quarter to see trends over quarters

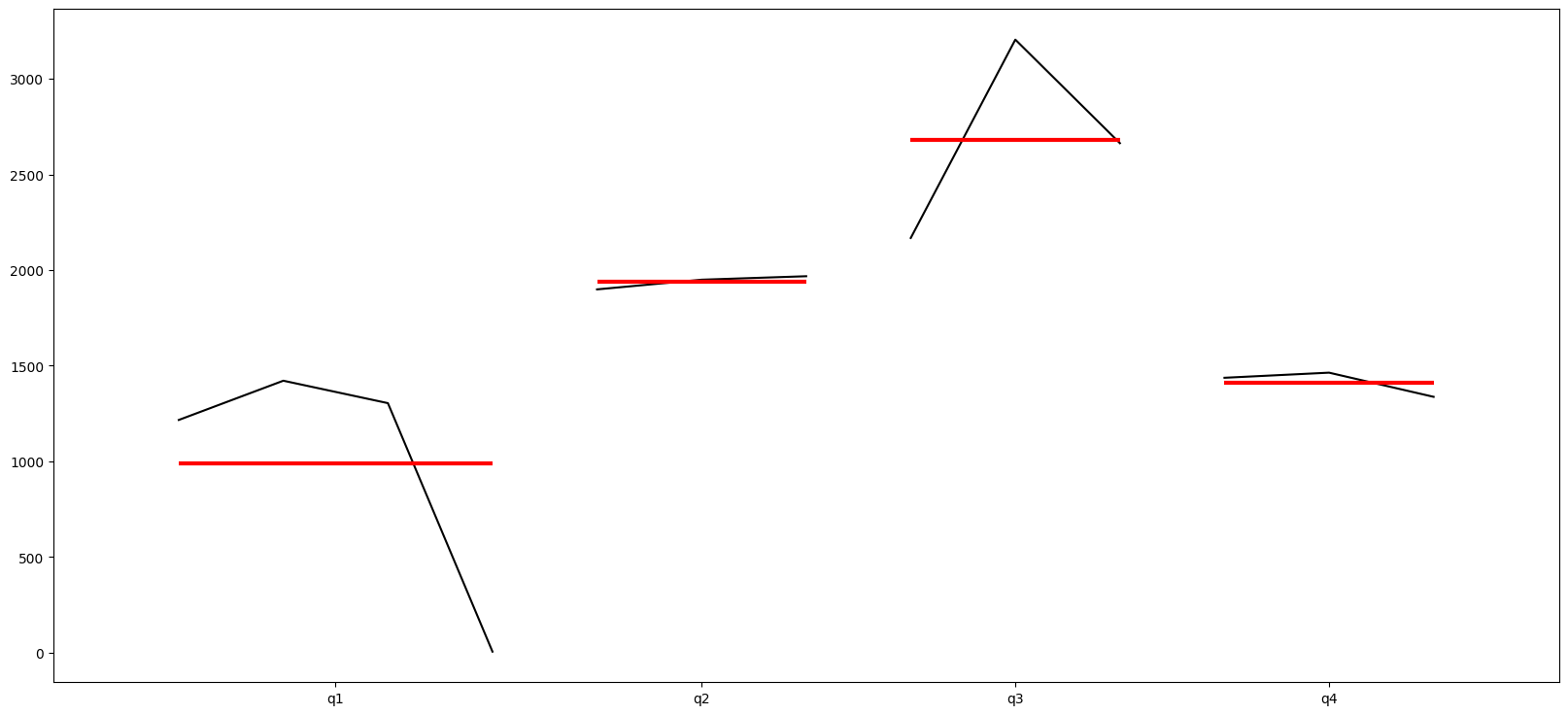

quarter_plot(df_elec[['kwh']].resample(rule='Q').kwh.sum());

Train-test split

# Train-test split

test_samples = 12

train_set = df_elec.iloc[:-test_samples]

test_set = df_elec.iloc[-test_samples:]

print("Training set: ", train_set.shape[0])

print("Test set: ", test_set.shape[0])

Training set: 145

Test set: 12

train_set

| Temp_avg | kwh | |

|---|---|---|

| Date | ||

| 2017-01-08 | 75.542857 | 106.5490 |

| 2017-01-15 | 71.014286 | 129.0960 |

| 2017-01-22 | 64.414286 | 68.7700 |

| 2017-01-29 | 56.728571 | 71.3780 |

| 2017-02-05 | 66.128571 | 107.8290 |

| ... | ... | ... |

| 2019-09-15 | 76.800000 | 168.3470 |

| 2019-09-22 | 79.385714 | 157.7260 |

| 2019-09-29 | 80.928571 | 191.8260 |

| 2019-10-06 | 70.771429 | 137.1698 |

| 2019-10-13 | 74.285714 | 147.5200 |

145 rows × 2 columns

test_set

| Temp_avg | kwh | |

|---|---|---|

| Date | ||

| 2019-10-20 | 73.471429 | 137.847 |

| 2019-10-27 | 64.557143 | 84.999 |

| 2019-11-03 | 62.928571 | 76.744 |

| 2019-11-10 | 77.985714 | 175.708 |

| 2019-11-17 | 49.042857 | 77.927 |

| 2019-11-24 | 62.785714 | 62.805 |

| 2019-12-01 | 69.557143 | 74.079 |

| 2019-12-08 | 74.371429 | 167.481 |

| 2019-12-15 | 61.242857 | 86.248 |

| 2019-12-22 | 50.000000 | 73.206 |

| 2019-12-29 | 60.128571 | 35.655 |

| 2020-01-05 | 7.185714 | 4.947 |

Uncomment this cell to run auto-ARIMA (very time consuming)

Determine parameters for SARIMAX using Auto-ARIMA

model = auto_arima(train_set['kwh'],seasonal=True,m=52)

order = model.get_params()['order']

seasonal_order = model.get_params()['seasonal_order']

print('Order = ', order)

print('Seasonal Order = ', seasonal_order)

# Set the order, ie the values of p, d, q and P, D, Q and m.

order = (1, 0, 1)

seasonal_order = (1, 0, 1, 52)

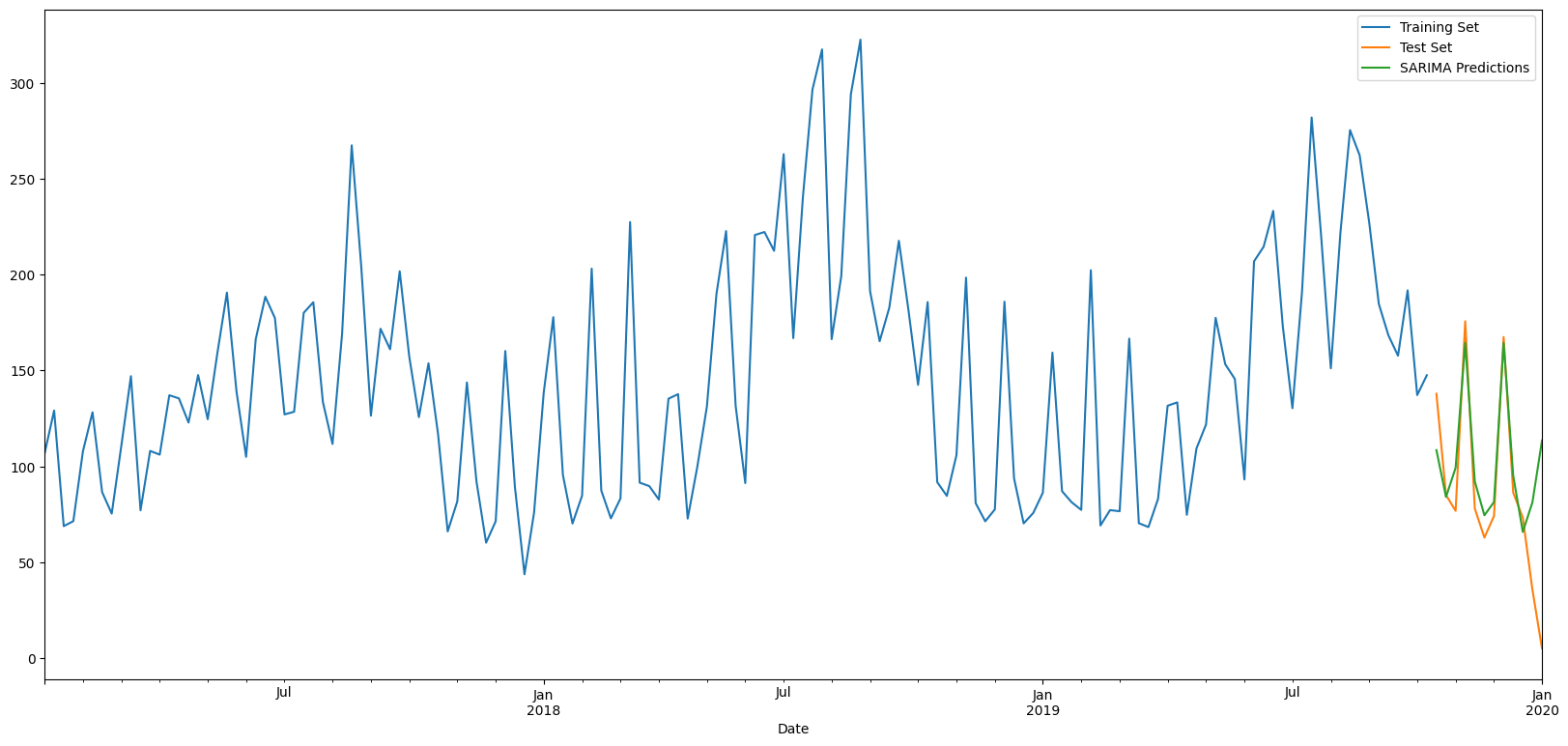

First, let us try SARIMA, ignoring temperature

# Create and fit model

from statsmodels.tsa.statespace.sarimax import SARIMAX

model_SARIMA = SARIMAX(train_set['kwh'],order=order,seasonal_order=seasonal_order)

model_SARIMA = model_SARIMA.fit()

# model_SARIMA.summary()

model_SARIMA.params

ar.L1 0.983883

ma.L1 -0.703757

ar.S.L52 0.994796

ma.S.L52 -0.842830

sigma2 781.564879

dtype: float64

# Create SARIMA predictions

start=len(train_set)

end=len(train_set)+len(test_set)-1

SARIMApredictions = model_SARIMA.predict(start=start, end=end, dynamic=False, typ='levels').rename('SARIMA Predictions')

# Calculate Evaluation Metrics

y_test = test_set['kwh']

y_pred = SARIMApredictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2019-10-20 | 137.847 | 108.432110 | 29.414890 |

| 2019-10-27 | 84.999 | 84.006054 | 0.992946 |

| 2019-11-03 | 76.744 | 99.242296 | -22.498296 |

| 2019-11-10 | 175.708 | 164.413570 | 11.294430 |

| 2019-11-17 | 77.927 | 92.077521 | -14.150521 |

| 2019-11-24 | 62.805 | 74.425502 | -11.620502 |

| 2019-12-01 | 74.079 | 81.382111 | -7.303111 |

| 2019-12-08 | 167.481 | 164.427999 | 3.053001 |

| 2019-12-15 | 86.248 | 95.116618 | -8.868618 |

| 2019-12-22 | 73.206 | 65.763267 | 7.442733 |

| 2019-12-29 | 35.655 | 81.148805 | -45.493805 |

| 2020-01-05 | 4.947 | 113.466587 | -108.519587 |

# Model evaluation

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 1323.1768701198491

RMSE = 36.375498211293944

MAE = 22.55437004082181

# Plot results

train_set['kwh'].rename('Training Set').plot(legend=True)

test_set['kwh'].rename('Test Set').plot(legend=True)

SARIMApredictions.plot(legend = True)

plt.show()

y_test

Date

2019-10-20 137.847

2019-10-27 84.999

2019-11-03 76.744

2019-11-10 175.708

2019-11-17 77.927

2019-11-24 62.805

2019-12-01 74.079

2019-12-08 167.481

2019-12-15 86.248

2019-12-22 73.206

2019-12-29 35.655

2020-01-05 4.947

Freq: W-SUN, Name: kwh, dtype: float64

Let us use SARIMAX - Seasonal ARIMA with eXogenous Variable

model = SARIMAX(endog=train_set['kwh'],exog=train_set['Temp_avg'],order=(1,0,0),seasonal_order=(2,0,0,7),enforce_invertibility=False)

results = model.fit()

results.summary()

| Dep. Variable: | kwh | No. Observations: | 145 |

|---|---|---|---|

| Model: | SARIMAX(1, 0, 0)x(2, 0, 0, 7) | Log Likelihood | -732.174 |

| Date: | Fri, 10 Nov 2023 | AIC | 1474.348 |

| Time: | 22:42:32 | BIC | 1489.232 |

| Sample: | 01-08-2017 | HQIC | 1480.396 |

| - 10-13-2019 | |||

| Covariance Type: | opg |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Temp_avg | 2.1916 | 0.096 | 22.781 | 0.000 | 2.003 | 2.380 |

| ar.L1 | 0.6524 | 0.064 | 10.202 | 0.000 | 0.527 | 0.778 |

| ar.S.L7 | -0.2007 | 0.089 | -2.261 | 0.024 | -0.375 | -0.027 |

| ar.S.L14 | -0.0945 | 0.090 | -1.048 | 0.294 | -0.271 | 0.082 |

| sigma2 | 1414.9974 | 193.794 | 7.302 | 0.000 | 1035.169 | 1794.826 |

| Ljung-Box (L1) (Q): | 0.20 | Jarque-Bera (JB): | 2.42 |

|---|---|---|---|

| Prob(Q): | 0.65 | Prob(JB): | 0.30 |

| Heteroskedasticity (H): | 1.42 | Skew: | 0.30 |

| Prob(H) (two-sided): | 0.23 | Kurtosis: | 2.80 |

Warnings:[1] Covariance matrix calculated using the outer product of gradients (complex-step).

# Create and fit model

from statsmodels.tsa.statespace.sarimax import SARIMAX

model_SARIMAX = SARIMAX(train_set['kwh'], exog = train_set['Temp_avg'], order=order,seasonal_order=seasonal_order)

model_SARIMAX = model_SARIMAX.fit()

# model_SARIMA.summary()

model_SARIMAX.params

Temp_avg 4.494951

ar.L1 0.994501

ma.L1 -0.672744

ar.S.L52 0.996258

ma.S.L52 -0.936537

sigma2 680.303411

dtype: float64

# Create SARIMAX predictions

exog = test_set[['Temp_avg']]

start=len(train_set)

end=len(train_set)+len(test_set)-1

SARIMAXpredictions = model_SARIMAX.predict(start=start, end=end, exog = exog, dynamic=False, typ='levels').rename('SARIMAX Predictions')

# Calculate Evaluation Metrics

y_test = test_set['kwh']

y_pred = SARIMAXpredictions

pd.DataFrame({'y_test': y_test, 'y_pred' : y_pred, 'diff':y_test - y_pred})

| y_test | y_pred | diff | |

|---|---|---|---|

| 2019-10-20 | 137.847 | 135.762630 | 2.084370 |

| 2019-10-27 | 84.999 | 90.884021 | -5.885021 |

| 2019-11-03 | 76.744 | 81.577953 | -4.833953 |

| 2019-11-10 | 175.708 | 172.860135 | 2.847865 |

| 2019-11-17 | 77.927 | 35.830430 | 42.096570 |

| 2019-11-24 | 62.805 | 89.152707 | -26.347707 |

| 2019-12-01 | 74.079 | 120.706976 | -46.627976 |

| 2019-12-08 | 167.481 | 150.329857 | 17.151143 |

| 2019-12-15 | 86.248 | 100.167290 | -13.919290 |

| 2019-12-22 | 73.206 | 22.178695 | 51.027305 |

| 2019-12-29 | 35.655 | 96.057753 | -60.402753 |

| 2020-01-05 | 4.947 | -156.713632 | 161.660632 |

# Metrics

from sklearn.metrics import mean_absolute_error, mean_squared_error

print('MSE = ', mean_squared_error(y_test,y_pred))

print('RMSE = ', np.sqrt(mean_squared_error(y_test,y_pred)))

print('MAE = ', mean_absolute_error(y_test,y_pred))

MSE = 3132.1077834193397

RMSE = 55.96523727653926

MAE = 36.240382161713455

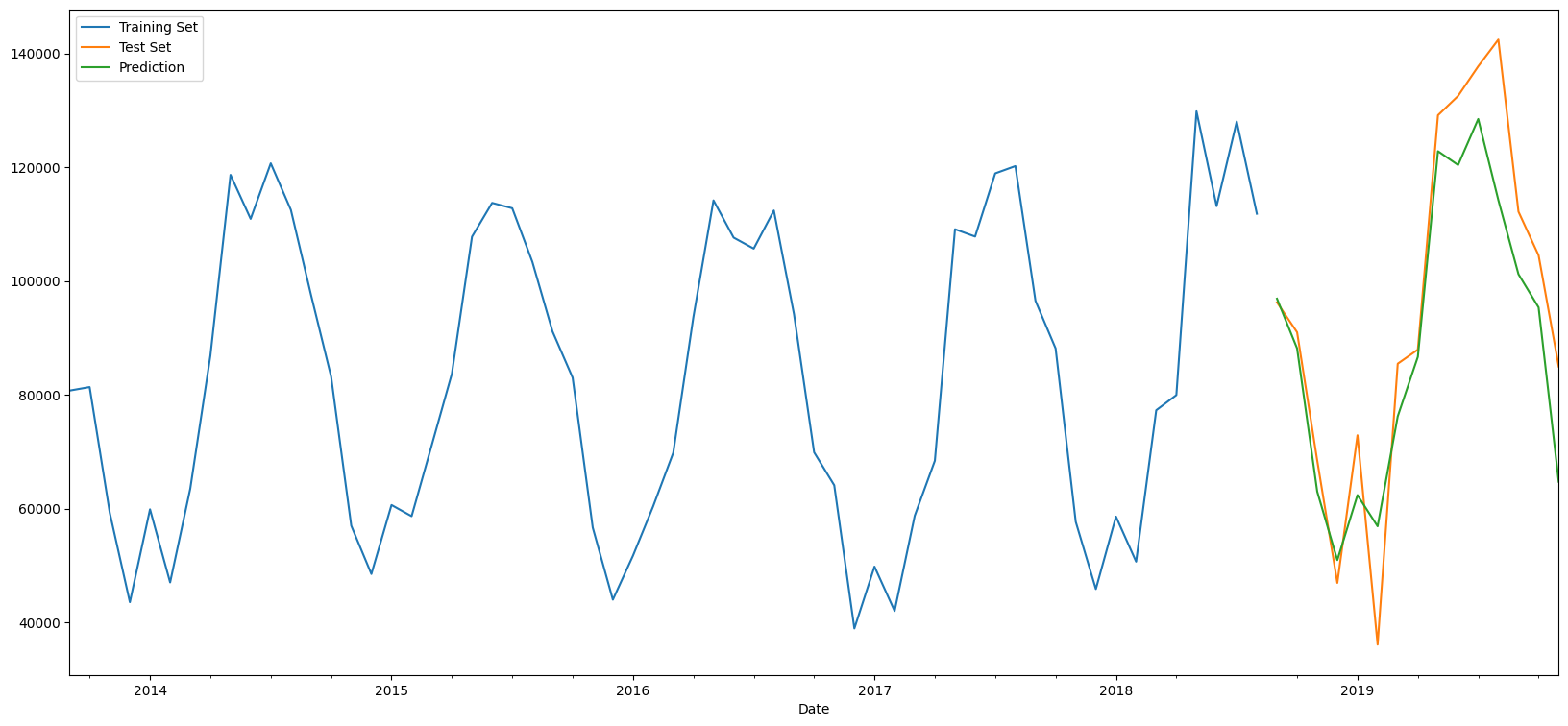

# Plot results

train_set['kwh'].rename('Training Set').plot(legend=True)

test_set['kwh'].rename('Test Set').plot(legend=True)

SARIMAXpredictions.plot(legend = True)

plt.show()

y_test

Date

2019-10-20 137.847

2019-10-27 84.999

2019-11-03 76.744

2019-11-10 175.708

2019-11-17 77.927

2019-11-24 62.805

2019-12-01 74.079

2019-12-08 167.481

2019-12-15 86.248

2019-12-22 73.206

2019-12-29 35.655

2020-01-05 4.947

Freq: W-SUN, Name: kwh, dtype: float64

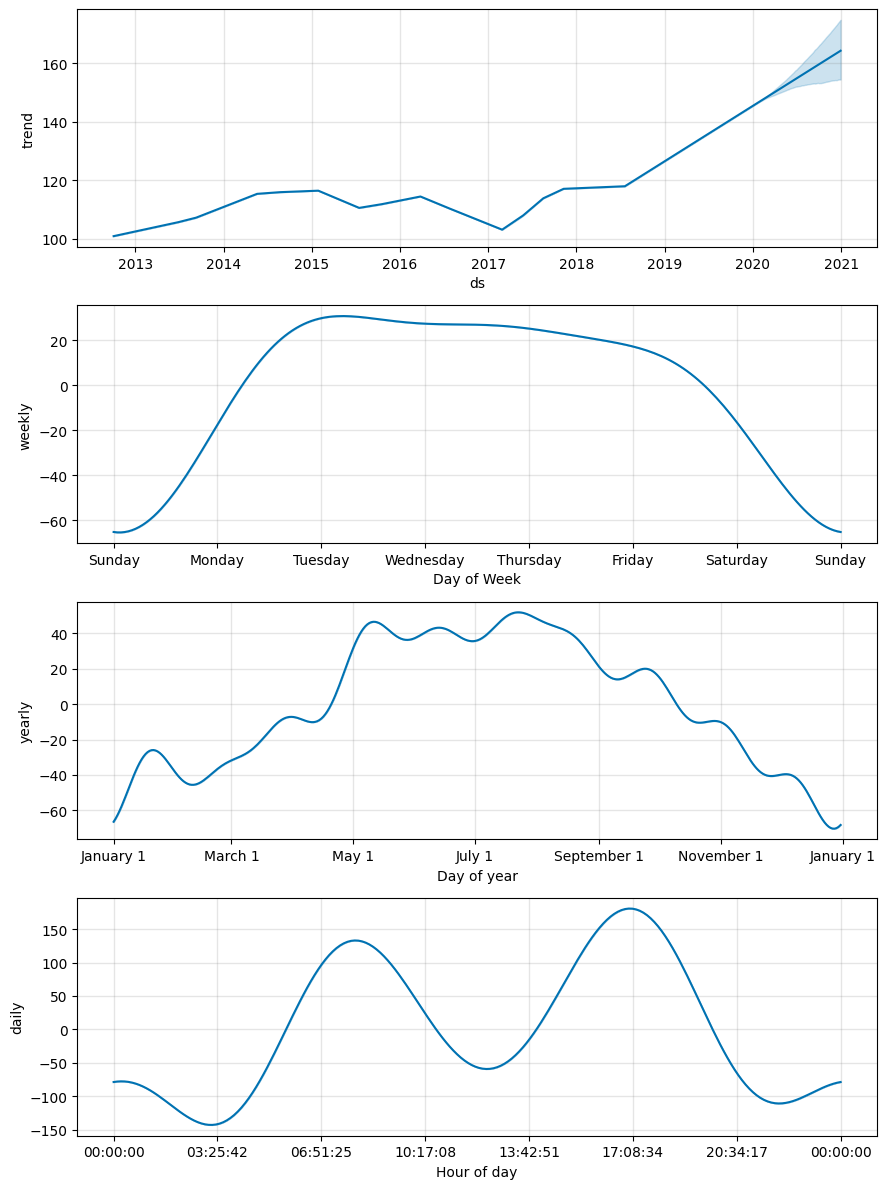

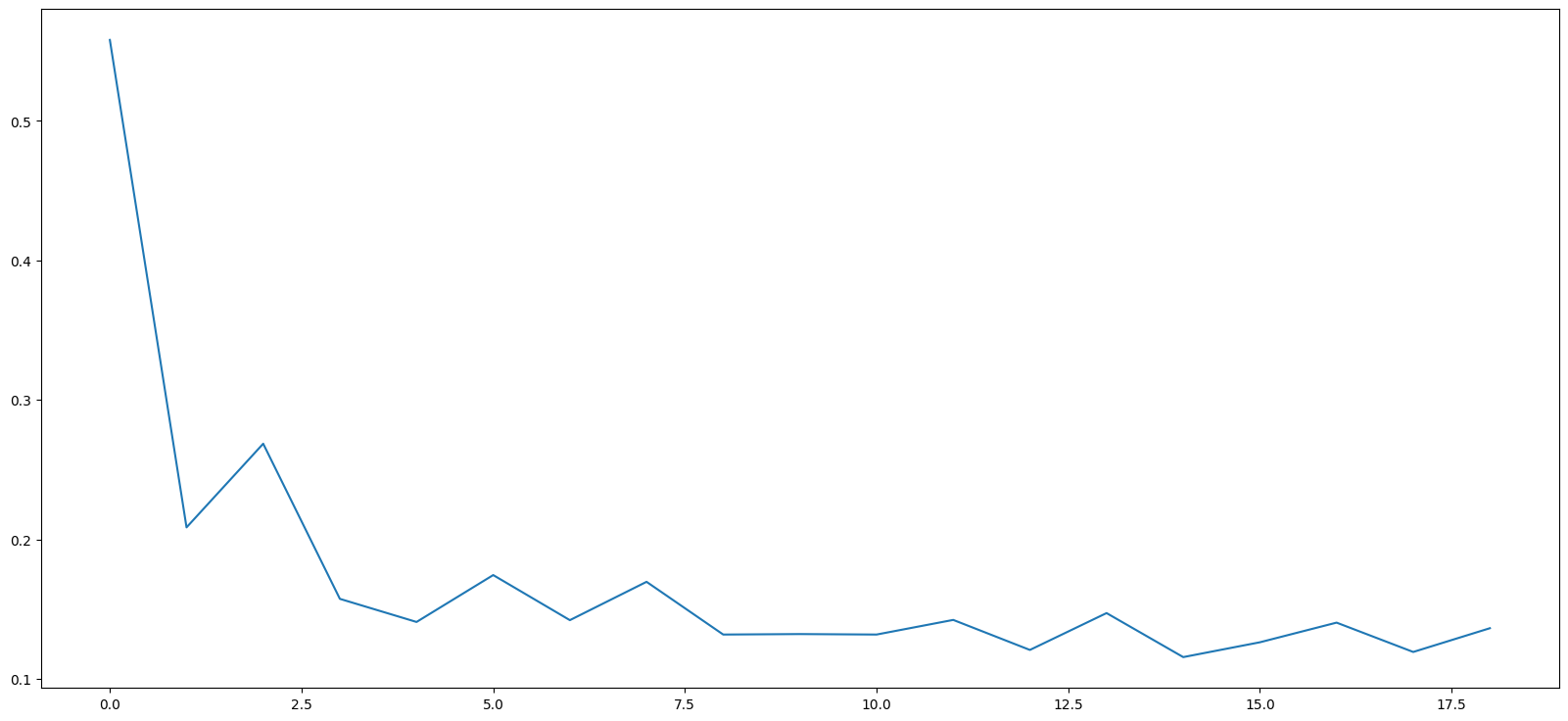

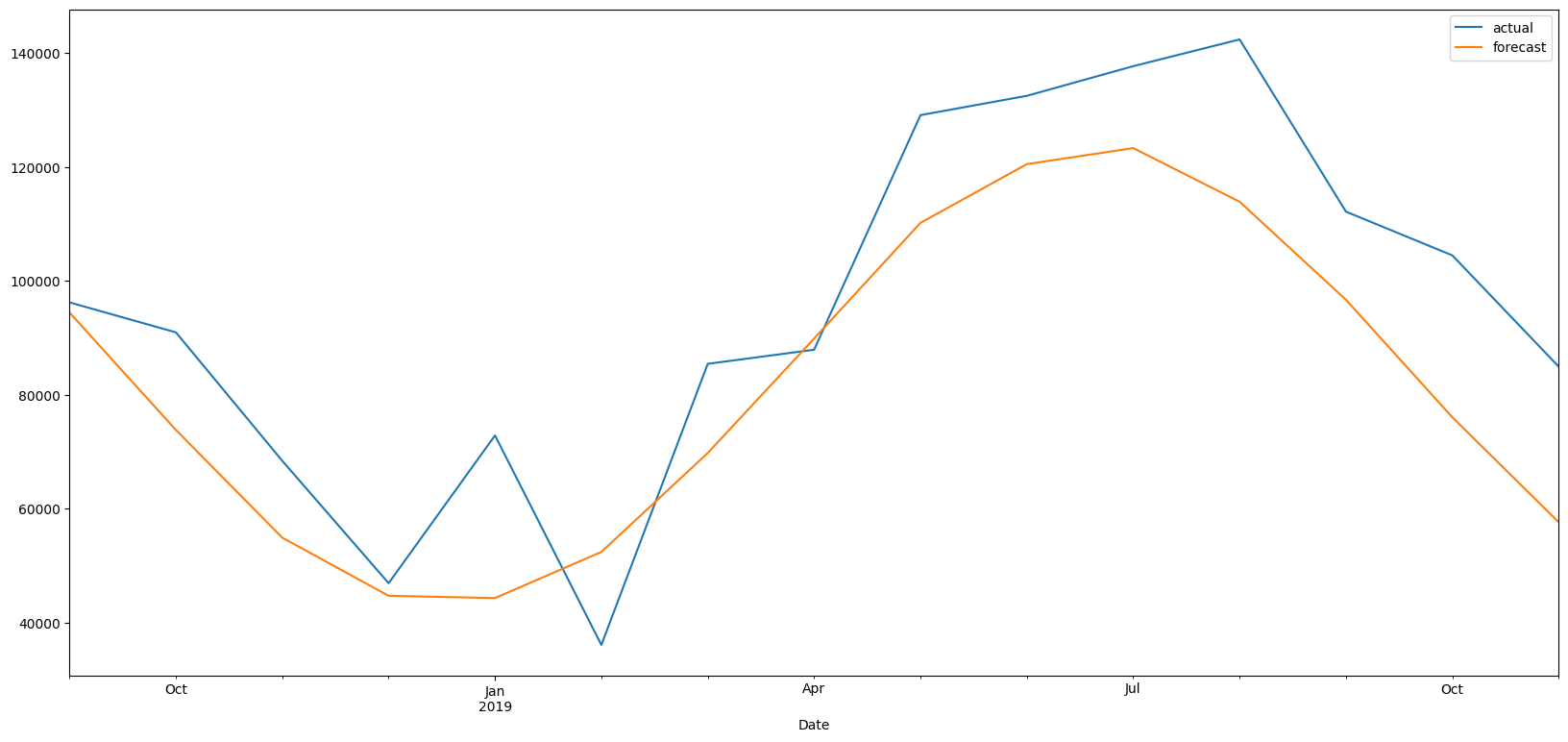

FB Prophet

https://facebook.github.io/prophet/